Overview of aluminium industry in the Middle East

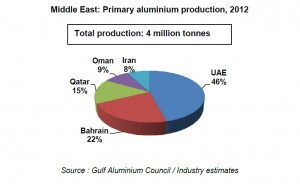

The Middle East region is poised to become a major hub for primary aluminium production over the coming decade. High energy and labour costs in North America and Europe have resulted in the shifting of production to China and the GCC countries, to some extent. With production at nearly 4 million tonnes, the Middle East region accounted for about 9% of the global primary aluminium production in 2012. DUBAL, EMAL, Alba, Sohar and Qatalum in GCC and Iralco, AAC and Hormozal in Iran are the primary aluminium producers in the Middle East region. The 740,000 tonne capacity Ma’aden smelter in Saudi Arabia has gone on stream recently in December 2012. With other capacity expansions planned, the region’s primary aluminium production capacity is set to reach 5 million tonnes per annum by 2014.

Though a major primary aluminium producing region, only about 20% of the total production is used by the domestic aluminium downstream industry in GCC and the rest is exported. However, in recent times, governments across GCC counties are supporting the development of aluminium downstream clusters.

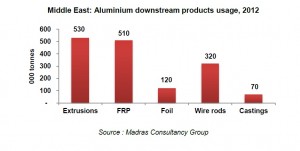

The Middle East region’s usage of aluminium in the form of flat rolled products (FRP) / foil, extrusions, wire-rods and castings, was close to 1.5 million tonnes in 2012. At present, the architectural, building and construction sector (ABC) is the main driver of the domestic aluminium downstream products demand. Packaging is also a key user segment for the local FRP manufacturers. Transportation, electrical and other industrial applications are the emerging markets for the future.

Aluminium extrusion

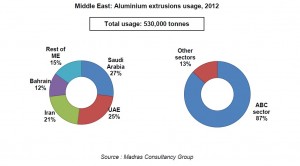

While the Middle East region has aluminium extrusion manufacturing capacity of around 750,000 tonnes per annum, the usage of extrusions in the region was 530,000 tonnes in 2012. Saudi Arabia, UAE, Iran and Bahrain accounted for about 85% of the aluminium extrusions usage in the region.

Architectural, building and construction applications accounted for about 87% of the extrusion market in the Middle East region. Qatar is expected to witness a spurt in the construction activity, in preparation for the FIFA world cup in 2022. With significant investments being made in the transportation, electrical and industrial sectors across the GCC countries, demand for aluminium extrusion products is expected to increase in the coming years.

Aluminium Products Company and Al Taiseer Aluminium Factory in Saudi Arabia, Gulf Extrusions, Al Jaber Aluminium Extrusions, Arabian Extrusion Factory, Elite Extrusion Company and DAC Extrusions in UAE, Bahrain Aluminium Extrusions in Bahrain, National Aluminium Products Company in Oman, Isfahan Coopal Aluminium Company in Iran, Arab Aluminium Industrial Company in Jordan are some of the leading producers of aluminium extrusions in the Middle East region.

Aluminium FRP

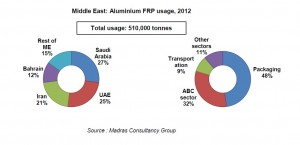

The aluminium FRP production capacity in the Middle East region stood at around 320,000 tonnes per annum in 2012. Domestic usage stood at a little above 500,000 tonnes. Saudi Arabia, UAE and Iran are the major markets in the region accounting for about 73% of the region’s aluminium FRP usage.

Packaging sector is the major end user segment of aluminium FRP in the Middle East region followed by the ABC sector. Of the aluminium FRP usage for packaging, canstock accounted for over 75% and foilstock usage accounted for close to 20%. Aluminium can manufacturing facilities are available in Saudi Arabia, UAE, Iran, Iraq and Jordan. The building and construction sector uses aluminium FRP for various applications including cladding, roofing, siding and doors. The use of aluminium FRP by the transportation sector in the GCC region is small. Bus coach building, rail wagon manufacturing, shipbuilding & repairing are viewed as some of the emerging application sectors of aluminium FRP in the Middle East region.

Gulf Aluminium Rolling Mill Co. (GARMCO) of Bahrain is at present the major aluminium FRP producer in the Middle East region. Profiles RHF in UAE and Hezar Aluminium Industries, Navard Aluminium and Aluminium Pars in Iran, are some of the other producers in the region. Other than GARMCO, the capacities of other mills in the region are not large and they cater to general engineering sector. However, this is set to change with new aluminium rolling mills being setup in Saudi Arabia (Ma’aden) and Oman (Oman Aluminium Rolling Company). Ma’aden’s rolling mill will have a capacity of 380,000 tonnes per annum while Oman Aluminium Rolling Company will have a capacity of 160,000 tonnes per annum.

Aluminium foil

Production of aluminium foil in the Middle East region is significantly short of demand, and hence large imports are taking place. GARMCO Foil Mill, Bahrain, a subsidiary of GARMCO is the key producer aluminium foil with a capacity of around 40,000 tonnes per annum. Iran has three mills with a combined capacity of around 20,000 tonnes.

The usage of aluminium foil in the Middle East region was estimated at 120,000 tonnes in 2012. Saudi Arabia, Iran, UAE and Bahrain accounted for more than 80% of the region’s aluminium foil usage in 2012. Semi-rigid containers and household foil are the two large applications of aluminium foil in the Middle East region and they contributed to around 45% of the aluminium foil usage in 2012. Some of the other key applications are converter foil, finstock and lidding foil.

Aluminium wire rods

Bahrain is the leading producer of aluminium wire rods with a total installed capacity to produce about 300,000 tonnes per annum. Midal Cables and Bahrain Welding Wire Products Manufacturing Company in Bahrain, Trans Gulf Aluminium LLC in Dubai and Pooya Gharb and Alumtek in Iran are some of the leading manufacturers of aluminium wire rods in the Middle East region.

Aluminium wire rods are used mainly for the manufacture of over head bare conductors. While the Middle East region has a capacity to produce about 450,000 tonnes per annum of aluminium wire rods, the domestic usage stood at around 320,000 tonnes in 2012. Midal Cables, Riyadh Cables, Saudi Cables, Oman Cables and Dubai Cables are some of the leading producers of cables and conductors in the GCC region.

The GCC electricity grid project remains the key demand driver for aluminium cables and conductors in the region. With urbanisation and rapid industrialisation, the GCC region is witnessing increased demand for energy. The installed capacity of the six GCC countries stood at around 97,000 MW in 2010, and apart from generation, the GCC region is also heavily investing in power transmission and distribution projects.

To sum up, the Middle East region not only provides opportunity for the primary aluminium sector but also offers immense potential for the development of downstream industries. With the support from governments and with investments taking place beyond the building and construction sector, the Middle East region is certain to become the aluminium power house of the world, in the near future.

Disclaimer:

This article entitled ‘The aluminium downstream markets in Middle East’ is intended to provide the reader a flavour of the aluminium downstream markets in the Middle East and has been prepared based on secondary research supported by data & estimates provided by MCG. Prior to undertaking any business or investment decisions, further detailed investigations / studies are recommended. The author can be contacted at gkshanker@gmail.com

Excellent coverage! But would the growth of downstream industries in Gulf region be a good or bad news for the Indian subcontinent aluminium downstream industry?

Interesting data !

Thanks Shanker for sharing.

Very much useful information.Where is Major enduse industry application and growth? Can we have similar blog for Indian Aluminium Industry?

Very interesting article. The increasing capacities in less expensive energy rich Gulf and protected economy China will pose a serious threat to Indian Aluminium Smelters. Time to introspect and work out strategies for survival.

As always, shaker’s articles give the reder first hand updates on what’s going on in the aluminium industry within the GCC with focuss on e GCC.

Just a note to say that most of the 20% metal that go to downstream is exported in the form without adding more values from third and fourth stage downstrea.

Thans Shanker for an excellent r

Thanks, appreciate all your comments. To respond, to Mr. Pani’s query – India has a well developed and diversified downstream sector – the issue is one of modernisation of the older plants, in order to be globally competitive. Major end user sectors such as ABC and transportation have taken off in India, and the manufacturers must make the investments to ward off competition.

Mr. Ray – will definitely write one on the Indian downstream soon !

Hi………..

Great blog nice n useful information , it is very helpful for me , I realy appreciate thanks for sharing. I would like to read more information thanks.

Very informative as usual of Mr Shankar . Look forward to some more on downstream

Quite an useful information for the potential investors in downstream industry .

great blog very informative what about India with energy cost going up will we be able to compete with China N Gulf

We have lost out to steel in Transport segment Wish Aluminum Association becomes more active for down stream Aluminum extrusion Industry

very informative and interesting information

except cheap power and financially sound to adapt modern technology how they are managing

to produce so much primary aluminium, is they have mines of bauxite or they import,

major working population belongs to india and best bauxite mines we have , but we are fail to produce and generate employment in india and indians managing things in the whole world.

whom to blame system,politicians or ourselves.

Dear Mr.Shanker,

Great article! Very informative.

I believe, Just to add few pointers…

# Midal cables wire rod production capacity is approx. 225,000 MT (including BWWP)and ME region (including Iran) total capacity would make it 360k MT precisely

# OAPIL (Oman) producing 45,000 MT of wirerods could have been included

Yes, you are absolutely right with the facts on immense opportunity with GCC aluminum downstream development. Already, ALBA has pioneered downstream cluster development as value addition to the economy & hope to see followers soon.

Best regards,

Chandrakumar BJG

chandrakumarj@frost.com

Mr Ratan – with light weighting becoming a key factor, there is an aluminium resurgence in the transport sector elsewhere in the world – leading Indian alu downstream companies need to invest in product-market development. China also has a high energy cost component now

Mr. Waheed – the smelters in GCC import alumina at present – only Saudi Arabia has bauxite – a large alumina refinery & smelter are being set up.

Hi,

Mr. Shanker, can i have your email address please and your contact numbers

Anyone in the group can help me with alloy cans for sprays

want to know if any factories there in the GCC.

Thanks

kammal

Mr. Adnani – you can mail me at shanker@mcg.in

Hi………….

Thanks a lot for sharing such a good source with all, i appreciate your efforts taken for the same. I found this worth sharing and must share this with all.

Dear Mr.S.Gopalakrishna,

Could you give your views in our preliminary planning to establish a downstream Aluminium can industry in Bahrain after engaging us as vendor to the contractors of ALBA,DUBAL,EMAL,SOHAR and QUTAUM in GCC,IRALCO,AAC and HARMOZAL in IRAN for the slurry pump parts and spares to those units importing from India where we manufacture the Pump parts and spares?

Regards.

T.N.Banerjee

A very good synoptic view.

Do you believe if there is sufficient worldwide demand to add further wire rod capacity in the middle east? Afterall this is where the metal production is growing.

Regards

Very good info on Middle East. Worth knowing more if any updates are availble

Nice share. One of the sectors that is booming is construction sector in UAE. There are many new construction companies that are entering the UAE construction sectors. That is the openness of the UAE sector. This interview clearly shows the new projects that are coming up in UAE.