Downstream also acts as the strategic bridge between metal production and end users. In practical terms, it links what smelters and recyclers produce to what automotive OEMs, construction firms, packaging converters, grid developers and electronics manufacturers actually buy.

When the downstream slows, the upstream feels it with a lag. When downstream upgrades are made, aluminium demand expands more durably.

Global downstream mix in 2024: What led consumption

A broad downstream consumption split for 2024 that helps frame where the metal is going:

- Extrusions: 34% of overall downstream consumption (about 34.5 million tonnes cited)

- FRP including foil: 32%

- Castings: 23%

- Wire and cables: 8%

- Other products: 3%

The takeaway is simple: extrusions and FRP together dominate the downstream footprint. If you want to understand where aluminium demand is expanding or breaking, these two product streams are the first place to look.

Key drivers pushing downstream demand

Lightweighting in transport: Transportation remains a structural driver, especially as EV platforms pull more aluminium into body structures, enclosures and thermal management systems. Adoption is expanding, but cost pressure remains a friction point in some applications.

Sustainability and circular economy: Aluminium’s recyclability and the push for lower-carbon materials is tightening the link between downstream demand and recycled input availability.

Urbanisation and infrastructure: Construction and infrastructure remain core, but the pace varies sharply by region. It is not a uniform story.

Technology-driven applications: Additive manufacturing, advanced casting and modern fabrication are opening new use cases, but they are not yet large enough to move the global needle alone.

Renewables and electrification: Grid upgrades, renewable capacity buildout and broader electrification are raising demand for wire, cable and related downstream components. Substitution from copper to aluminium is also part of the story, where technically viable.

Regional demand lens: What’s changing

Americas: North America showed softness in parts of downstream demand, with domestic shipment weakness and a visible demand decline noted in the session. At the same time, recycling momentum was described as strong with significant investment in recycling capacity.

Central and South America were positioned as “new market momentum” regions. Brazil stood out through can demand growth, infrastructure expansion and a very high can recycling rate trend, although the session noted a drop in 2024 compared with the prior two years.

Europe: Europe’s downstream picture was mixed. Early 2025 automotive weakness was flagged, with softer registrations and reduced momentum. Construction was described as heading into a mild recovery, while packaging was viewed as relatively more resilient due to sustainability-led substitution and recycling-driven consumer preferences.

Recycling growth was framed as structurally supported by regulation and secondary capacity buildout. The message was clear: Europe’s downstream demand is being increasingly shaped by policy and circularity constraints, not just GDP.

China: China’s transport signal was mixed: month-on-month volatility but year-on-year strength in some indicators. The session highlighted power-sector investment strength and flagged the electrical segment as a fast-growing demand contributor.

Construction remained the weak point, with housing-related investment declines cited as a continuing drag. The implication is that China’s downstream demand mix is increasingly reliant on transport and power rather than real estate.

Rest of Asia-Pacific (excluding China): This region was framed as one of the strongest multi-sector growth zones: data centres, renewables additions and rising vehicle registrations were the key proof points.

India’s role was called out as a major contributor within the region, with broader momentum across Southeast Asia supported by policy and investment cycles.

Trade and tariffs: Why downstream flows are diverging

A major section of the webinar focused on how US trade actions and tariff regimes are influencing downstream shipments, imports and exports. The practical effect described in the session is divergence, some corridors tightening, others rerouting and several markets showing visible year-on-year declines in selected product categories.

The point for downstream players is not simply that tariffs exist. It is that pricing, realisation and competitiveness now depend far more on origin, product code, timing and contract structure than they did before. This is exactly why downstream procurement and pricing strategy is becoming as important as manufacturing efficiency.

Product outlook: What to watch by segment

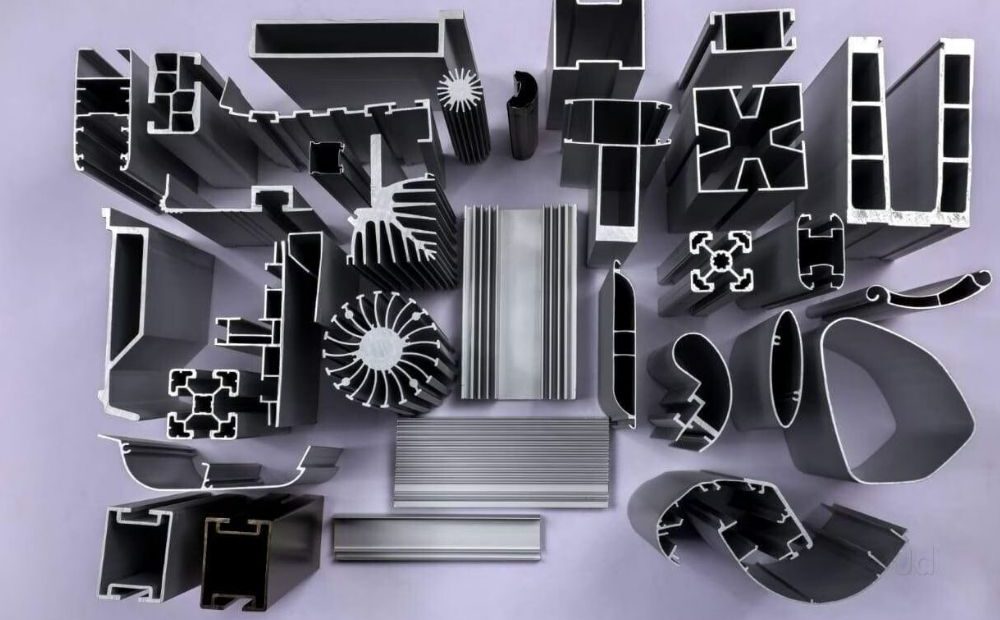

Extrusions: Global extrusion demand was stated at about 34.5 million tonnes in 2024, with a modest rise expected in 2025 and a larger projection into 2032. Drivers highlighted included construction recovery in some markets, EV lightweighting, data centres and solar installations.

FRP and foil: FRP demand was linked strongly to packaging, transport and construction. Foil was framed as a sector seeing continued capacity expansion in parts of Asia, including India and Southeast Asia, supported by flexible packaging, household packaging and pharma applications. EV-linked applications such as battery-related packaging were also referenced.

Castings and wire: Castings were framed as essential for complex shapes and high-performance components, especially in automotive and industrial machinery. Wire and cables remain tied to electrification and grid upgrade cycles.

Trade outlook by product

The session walked through import and export trends across key markets for extrusions, pipes and tubes, plates, sheets and foil. The repeated pattern was that several major markets showed year-on-year declines in 2025 versus 2024 in selected categories, reinforcing the theme of trade flow adjustment under tariffs and weaker pockets of demand.

End-use demand split: Where downstream output goes

- Transportation: 27%

- Building and construction: 22%

- Packaging: 16%

- Electrical and electronics: 14%

- Industrial: 8%

- Others: 13%

This matters because it tells you where downstream manufacturers are most exposed. If transport stays resilient, casting and extrusion hold up better. If packaging stays strong, FRP and foil remain more defensive. If grid investment accelerates, wire and cable demand becomes a bigger swing factor.

Recycling outlook: The demand tailwind that’s not optional

Recycled aluminium consumption was cited at about 28.9 million tonnes in 2024, rising to 29.9 million tonnes in 2025, with a market growth projection into 2032. The drivers were consistent: regulation, cost advantage of secondary metal, and rising downstream requirements for lower-carbon inputs.

In short, recycling is no longer a side theme. It is becoming a constraint and a competitive lever at the same time.

New demand frontier: Humanoid robotics

One of the most interesting “new sector” mentions was humanoid robotics, where aluminium usage per unit was cited in the range of 15-20 kg, with potential to extend higher depending on design. The relevance here is not the absolute tonnage today. It is the signal: new manufacturing categories are emerging where lightweight structures and thermal management are central, which plays directly into aluminium’s strengths.

What this means for downstream players going into 2026

If you operate in the downstream aluminium industry, the next phase is not just about waiting for demand to return. It is about positioning against three realities:

- Demand is fragmenting by region and by end-use rather than rising evenly

- Trade policy is directly reshaping price realisation and shipment viability

- Recycled input access and quality are becoming strategic advantages, not procurement details

Downstream demand will keep growing, but the winners will be the ones who control cost, control quality and control market access.