At the end of October, SMM reported aluminium smelters in Yunnan province of China have been asked to cut output again during the dry season (from November to April next year), which could affect more than 1 million tonnes of operational capacity. Although Yunnan is a hydro-rich province, the rapidly growing electricity demand will give huge pressure on hydro power supply, especially during the dry season. SMM believes it is not easy to fix the hydropower shortage issue in Yunnan within the next few years. However, Chinese aluminium industry will continue becoming more sustainable year by year.

Huge investment in renewable energy accelerates the structural change in China’s power industry

In September 2020, President Xi Jinping announced that the People’s Republic of China will “aim to have carbon emissions peak before 2030 and achieve carbon neutrality before 2060.” The country has significantly increased the investment in renewable energy sector to reduce carbon emission from the power industry ever since. China’s national emissions trading scheme (ETS) went into operation in July 2021, which regulates more than 2,000 companies from the power sector with annual emissions of over 26,000 tonnes CO2, including combined heat and power, as well as captive power plants in other sectors. SMM believes that aluminium industry will be the next sector covered by the ETS soon, which will encourage smelters to reduce carbon emissions.

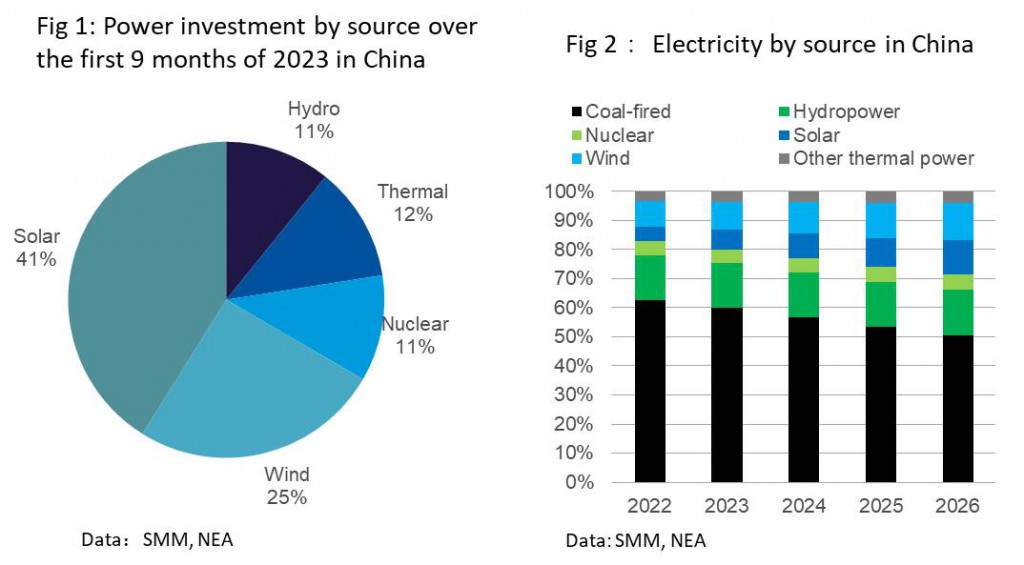

Over the first three quarters of 2023, China has invested RMB 553.8 billion in the power generation projects, of which 41 per cent and 25 per cent are allotted for solar and wind power projects, while only 12 per cent is earmarked for thermal power generation. SMM believes China will continue to advocate for more renewable power sources next few years in order to achieve the carbon emissions peak before 2030. The low capex requirement from solar and wind power also supports the investment enthusiasm. We estimate that contribution of coal-fired power generation could decrease to 50% by 2026 in China, which is much quicker than expected.

In September 2023, the National Development and Reform Commission (NDRC) issued the Basic Rules of Electricity Spot Market to accelerate electricity market reform, combining with previous regulations, like the Basic Rules for Medium and Long-term Electricity Trading, which encourage power consumers to shift to renewable power sources. Chinese aluminium smelters could improve their carbon footprint by purchasing more green power and reducing electricity generated from their own coal-fired power stations, which also could reduce their power costs by adopting good trading strategies in the power market. According to the carbon border adjustment mechanism (CBAM) regulation, the indirect emissions embedded in aluminium products should be determined on a default value, the emission factor of the country of origin electricity grid. We expect this default value for China’s power grid would decline year by year. At the same time, if the power purchase agreements (PPAs) that Chinese aluminium smelters signed with renewable energy producers can be approved by the EU, it also would reduce the CBAM impact on their products.

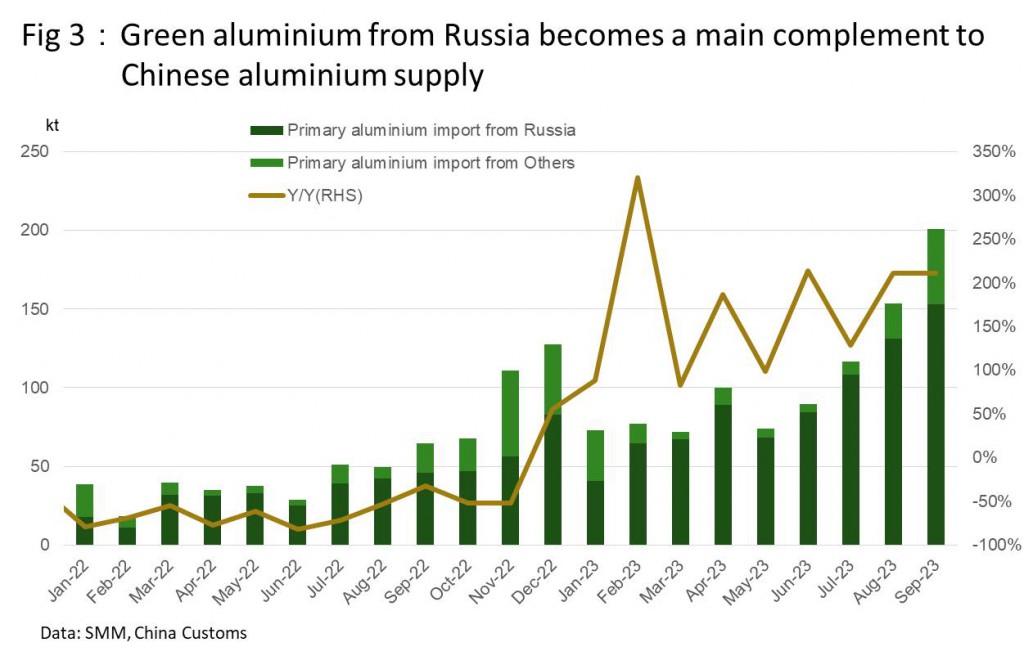

Imports and recycling will be the key complement to meet domestic demand as the smelting cap policy remains effective

As the aluminium smelting capacity cap policy is expected to become a long-term regulation on Chinese aluminium industry, China needs to import more primary aluminium ingot to meet domestic demand. For well-known reasons, Russia shifted to export more aluminium ingot to China from its traditional markets. From the perspective of sustainability, these green aluminium from Russia plays a crucial part in helping Chinese downstream producers to reduce the supply chain carbon emissions of their products. Over the first 9 months of 2023, China imported 806,000 tonnes of aluminium ingot from Russia, which may exceed 1million tonnes at the end of the year.

The other consequence in reaction to the aluminium smelting capacity cap policy is that Chinese companies, especially downstream producers, are heavily investing in recycling facilities. As SMM understands, Henan Mingtai, the largest aluminium rolling mill in China, could achieve 1 million tonnes of recycling capacity in 2024. In recent years, other rolling mills, like Shandong Nanshan, Shandong Weiqiao, Henan Zhongfu, Baotou Changlv, Zhejiang Mingdao, Guangxi Runtai and Anhui Limu, have invested in their recycling capacity. Chinese aluminium extrusion companies and other downstream players have done the same thing.

Recycling can improve the sustainability of Chinese aluminium industry. As old aluminium scrap could be increasingly available in the domestic market in the future, recycling will become the other main complement to aluminium supply in China. At the same time, overseas clients of Chinese aluminium products would like to see more recycled content in their aluminium goods to meet the sustainable supply chain requirement. Although the EU may adjust the CBAM regulation in the future, currently CBAM still considers that recycled aluminium has zero carbon emissions.

Compared to some countries like Norway, Canada and Iceland, others in the world, like China, don’t have substantial hydropower available in hand for aluminium industry. Despite lacking this natural advantage, Chinese aluminium industry has done lots of efforts to improve the sustainability, such as the unprecedented relocation projects from coal-fired power to hydro power within the global aluminium industry. Continuing its commitment, Chinese aluminium industry aims to reduce carbon emissions and improve the sustainability at its own pace, contributing to the global environmental efforts with yet another surprising achievement.