The threat of climate change, and the growing focus on a carbon-neutral world and the implementation of a circular economy has changed the way heavy industries operate now. The result was the Paris Agreement in 2016, which set up an aim of keeping global warming below 2 degrees Celsius over the 21st century.

This transformation is driving a series of much-needed changes in the product development process, technology, and the end-use of materials. Aluminium and a range of other metals are expected to play a key role in this transformation process.

The aluminium sector is growing exponentially driven by rising demand from the transport, construction, packaging, and energy sector because of its green credentials. It is one of the most sought-after metals because of its qualities such as lightweight, malleability, corrosion resistance, electrical and thermal conductivity, affordability, and recyclability. However, the aluminium sector has the strange dichotomy of being a solution to a problem, and a part of the problem at the same time. Despite being the greenest metal on earth it is also a part of the sustainability challenges faced by the earth.

The challenge lies in the fact that growing production of aluminium may result in CO2eqlevels reaching a dangerous level if no substantial action is taken. Along with that, the sector gives rise to a series of other sustainability issues such as huge waste and scrap generation, landfills, and downgrading. The situation demands industry majors and policymakers to plan and act quickly to reduce aluminium greenhouse gas emissions and address the cradle-to-gate sustainability challenges. This is not only an environmental challenge but, an economic, social, and technological one. Although the industry majors and the organizations are working towards developing a sustainability roadmap for the aluminium industry, it has a long way to go.

What does the data show?

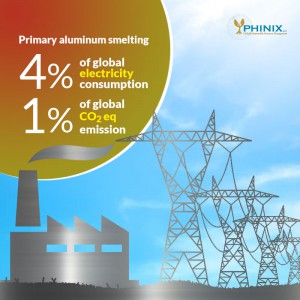

According to the 2019 data from International Aluminium Institute (IAI), the aluminium sector is responsible for 1.05 billion tonnes of greenhouse gas emissions per annum, close to 2% of all global emissions. CO2eq emissions from Electricity Electrolysis contribute more than 90% of this footprint. The data shows about an average of 12.8 tonnes of CO2eq was emitted per tonne of primary aluminium production in 2019 during the electrolysis process. However, if we consider cradle-to-gate emission, it comes to about 16.5 tonnes per tonne of aluminium.

Interestingly, only the direct electricity consumption during electrolysis can generate about 10.4 tonnes of CO2eq per tonne of aluminium.

According to IAI’s material flow analysis (IAI, 2021) demand for aluminium is expected to grow by 80% by 2050. This indicates the possibility of huge CO2eq emissions from the primary aluminium industry in the next decades. Since primary aluminium currently makes up around 70% of annual metal demand, the current effort by industry majors and organizations mostly focuses on reducing carbon footprint using green fuel and alternative technology and boosting aluminium recycling.

Converting challenges into opportunities

Despite having numerous challenges, innovative technologies have supported the industry to address these challenges. Sustainability benchmarks have improved significantly in the last two decades in the aluminium sector. The pressure to redesign the production process in line with societal climate goals has opened doors for aluminium producers and manufacturers and allied industries to explore new technologies. A parallel market is also taking shape for low carbon aluminium as a commercial product creating opportunities for the metal exchanges and financial institutions to expand their markets.

The pressure to produce low carbon aluminium is also compelling conventional aluminium producers to recalibrate their strategies. For example, China Hongqiao Group, one of the largest aluminium producers globally, is aiming to move about one-third of its aluminium capacity out of Shandong province to the hydropower-rich Yunnan province to produce greener aluminium.

I am highlighting some of the latest developments towards producing low carbon aluminium below:

1. Low carbon aluminium (Hydro-powered aluminium and inert anode technology)

The concept of low carbon aluminium is primarily based on the direct and indirect emission during the electrolysis process. The industry has not been able to set up an exact definition or benchmark for low carbon aluminium as a product. However, all the current green aluminium brands range within 4 ton direct and indirect CO2eq emissions. This benchmark is also promoted by Carbon Trust’s Methodology statement and covers process emissions from aluminium electrolysis, anode production, and aluminium casting. The reduction in CO2eq emission is achieved through a combination of the use of hydropower and inert anode and cathode technology.

Several aluminium producers have already launched ‘low carbon primary aluminium’ products. Some of the key low carbon aluminium products include Rio Tinto’s RenewAl, Rusal’s Allow, Hydro’s CIRCAL 75R and REDUXA 4.0, and Alcoa’s Ecolum. A significant development in this space, Elysis, a joint venture of aluminium major Alcoa and Rio Tinto and supported by the Canadian government produced its first commercial batch of low carbon aluminium in December 2019. Elysis has already signed low carbon aluminium supply deals with Apple and American brewing company Anheuser-Busch InBev NV.

2. Exploring solar power as a fuel for aluminium production

The sun remains the most powerful source of energy in the world to date and hence solar energy is the next big renewable energy source to invest in. With the option of exploring hydropower getting more limited, aluminium producers are exploring solar energy potentials to use as a fuel source. The Middle East countries are rediscovering the power of the sun and exploring solar energy as a fuel source.

Notably, Emirates Global Aluminium (EGA) already achieved a sustainability milestone in January 2021 by producing aluminium using solar power from Dubai Electricity and Water Authority (DEWA). DEWA will supply 560,000-megawatt-hours of solar power yearly to EGA smelter in Abu Dhabi. EGA plans to produce 43,000 tons of solar-powered aluminium in the first year with an expansion plan.

3. Aluminium Sustainability Initiative (ISI)

The Aluminium Stewardship Initiative (ASI) is an organization working towards setting up a sustainable standard for aluminium production. It is a global non-profit certification organization that is setting a standard for responsible production, sourcing, and stewardship of aluminium following an entire value chain approach. As per their benchmark, aluminium products from smelters that meet the 2030 ASI Performance Standard of 8 tons of direct and indirect CO2eq emission per ton aluminium produced are certified as low carbon aluminium. This is considered a too inclusive benchmark for low carbon aluminium by experts, but an achievable goal when we consider the current 12.8-tonne emission standard. The organization has created a strong sustainability benchmark for aluminium production and manufacturing and issued more than 50 ASI Certifications — for both Performance and Chain of Custody.

4. Aluminium Sector Greenhouse Gas Pathways to 2050

International Aluminium Institute (IAI), which represents over 60% of global bauxite, alumina, and aluminium production through its membership, has been working towards building a sustainable aluminium industry through its programmes. To manage the carbon footprints of the aluminium industry, IAI has proposed three levels of disclosure of carbon footprints. While Level 1 comprises emission from the entire electrolysis process, Level 2 comprises emission from bauxite mining and alumina refining including electricity generation. Level 3 covers cradle-to-gate emission.

The institute is now exploring realistic and credible technological pathways for 2050 sector-wide greenhouse gas emissions reduction. These pathways are in line with the Paris Agreement goal to limit global warming to well below 2°C, preferably to 1.5°C. Underpinned by industrial and material data and analyses, the IAI has mapped out the three main routes for the aluminium industry to achieve global climate goals (while addressing other sustainability issues).

(For more information on this visit: https://www.world-aluminium.org/)

5. A market for low carbon aluminium

Expecting a forward graph in consumer demand for low carbon aluminium, metal exchanges, financial markets, commodity market specialists, and pricing analysts are conceptualizing green premium as a product with a proper benchmark, price, and premium. Significant milestones have been achieved in this regard by London Metal Exchange, Fastmarkets, HARBOR Aluminum, and Trafigura.

Other Sustainability Challenges

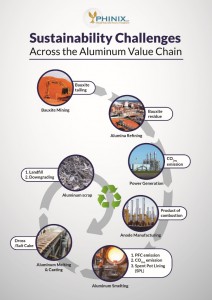

While CO2eq emission remains the biggest threat to the aluminium sector, the industry faces numerous sustainability challenges across the value chain, which are the natural impact of the long three-stage production process. Some of the other critical issues faced by the aluminium industry are:

- Bauxite residue or red mud

- Spent pot lining

- Dross and scrap generation

- Landfilling and downgrading

Without going into the detail of these critical sustainability issues in this article, I would like to emphasize that an exclusive focus on the energy source could end up overshadowing these challenges in the value chain These issues demand equal focus across the aluminium producing countries.

Aluminium Recycling: a boon

All the by-products, residues, and end-of-life products from the aluminium value chain end in landfills if not recycled or reutilized. Aluminium is blessed with 100% recyclability, which can neutralize the entire aluminium smelting carbon footprint at the end of its lifecycle. Secondary aluminium or recycled aluminium production an environment-friendly process that is 92% more energy-efficient than primary production. The adoption of recycled aluminium in manufacturing has proved to be economically and environmentally beneficial for the industry as well as the end-users.

For example, nearly 43% of the US aluminium supply is now met through secondary production. In 2020, aluminium recovered from scrap in the US was about 3.2 million tonnes, while primary production stood at just 1 million tonnes further, recycled aluminium was equivalent to about 51% of apparent consumption. The data highlights the endless possibility of how more and more primary aluminium can be substituted with secondary aluminium.

With the worldwide campaign of the circular economy gaining ground, the aluminium industry cannot afford to shift its focus from recycling. A planned recycling program for the industry and the implementation of close loop recycling across the downstream value chain can save a huge volume of aluminium from ending in landfills.

The bottom line

Notwithstanding all the sustainability challenges, aluminium has the potential to be the change-maker in the journey towards a carbon-neutral world. With such versatility of uses across the industries, and especially in the green energy, transport, packaging, and building segment, it is supposed to be the metal of the future. In a growth market like aluminium, the world needs every pound of aluminium that is made, whether it is produced from fossil fuel and in the conventional method or in a greener way. Not all producers can have access to hydropower, which is a finite resource. This justifies the need to work towards building up a chain of sustainability across the value chain, addressing all the issues. Technological advancement must take place towards reducing carbon footprint in electricity productions despite using fossil fuels and reducing energy consumption in the smelting process and alumina refining. Further, a planned approach is needed to address the issue of bauxite residue, SPL, and scrap and dross generation and landfilling. While the mentoring organizations are doing their part, such an effort needs collaboration from producers, policymakers, R&D persons, financial and trading platforms, end-users, as well as customers.

Dr. Subodh Das, a globally recognized expert and consultant in aluminium and light metals and a serial intrapreneur.