The aluminium industry stands at a fascinating crossroads in 2025. The race between primary aluminium and recycled aluminium is not just about production volumes or market share anymore—it’s about meeting the demands of a rapidly changing world where sustainability, efficiency, and cost competitiveness are key.

According to our newly released “Global Primary and Recycled Aluminium Industry Outlook 2025”, both sectors are expanding, yet differently: primary aluminium remains essential for industries demanding quality and consistency, while recycled aluminium is rapidly gaining ground as the greener, more cost-effective choice.

Primary Aluminium: Resilient, yet under pressure

Primary aluminium production is forecasted to surpass more than 2024 in 2025, growing steadily despite a host of challenges. Demand remains robust, fuelled by sectors like transportation (especially electric vehicles), renewable energy infrastructure (solar panels, wind turbines), and construction.

Key dynamics for primary aluminium:

- Growth areas: Transportation, solar energy, infrastructure expansion in emerging markets like India and ASEAN.

- Challenges: High energy costs, stringent environmental regulations, and trade tensions continue to squeeze margins, especially in Europe and North America.

- Regional trends: China dominates production but is nearing its regulatory production ceiling. Meanwhile, the Middle East, ASEAN, and India are ramping up their capacity.

- Price forecast: Aluminium prices are expected to stabilise, supported by supply deficits and strong energy transition demand.

But sustainability concerns loom large: primary aluminium production remains energy-intensive, with substantial CO₂ emissions. Even with strides toward renewable-powered smelters, achieving net-zero targets remains a long, capital-heavy journey.

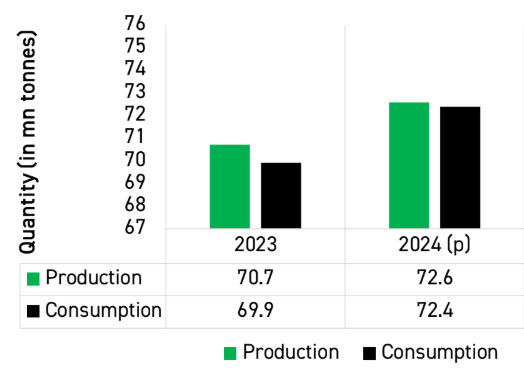

Primary aluminium market volume, 2023-25 (in million tonnes)

Recycled Aluminium: The fast-rising contender

In contrast, recycled aluminium (secondary aluminium) is witnessing an acceleration in both demand and investment. By 2025, recycled aluminium is projected to command a larger slice of the overall aluminium consumption pie.

Why recycled aluminium is surging:

- Energy efficiency: Producing recycled aluminium requires only 5% of the energy needed for primary aluminium production.

- Cost advantage: Lower energy and raw material costs make recycled aluminium highly attractive, especially as industries look to cut carbon footprints and costs.

- Circular economy push: Governments and corporations globally are prioritising recycled content across the automotive, packaging, and construction sectors.

- Technological innovation: New scrap sorting, dross recycling, and remelting technologies are enhancing both quality and efficiency.

Investments in aluminium recycling facilities—green and brownfield—are booming, especially in Europe, North America, and increasingly Southeast Asia.

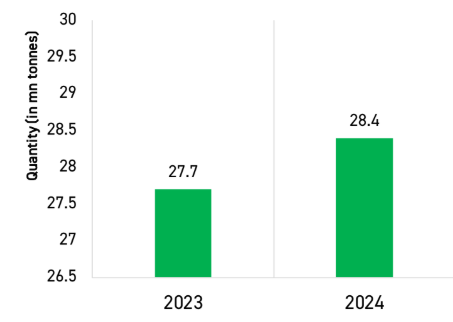

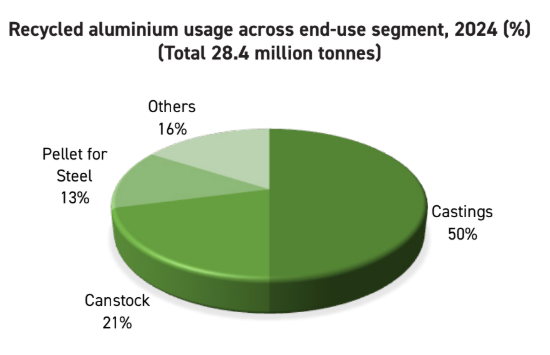

Global recycled aluminium usage, 2023-2024 (in million tonnes)

Source: AL Circle estimate; Consultation – Wood Mackenzie

Sector competition: Primary vs Recycled — A coexistence or a battle?

Rather than a “winner-takes-all” competition, primary and recycled aluminium is increasingly coexisting in a complementary ecosystem.

- Primary aluminium is indispensable for high-purity applications such as aerospace structures, premium auto bodies, and high-end electrical components.

- Recycled/secondary aluminium is fast becoming the material of choice for packaging (beverage cans), construction materials (window frames, cladding), and standard automotive components.

However, scrap availability is becoming a bottleneck. With recycled aluminium relying heavily on scrap collection systems, regions without robust recycling infrastructures face constraints. Moreover, the demand for recycled aluminium sometimes outpaces scrap generation growth, pushing prices higher.

In contrast, primary aluminium producers continue to invest in low-carbon technologies, such as inert anode technology and renewable energy-based smelting, aiming to stay relevant in a carbon-constrained world.

2025: Key predictions for the aluminium industry

From our report analysis, here’s how we see the year shaping up:

- Sustainability will be the core theme across both primary and recycled aluminium sectors.

- Primary aluminium will face continued energy pressures but benefit from modest production growth and strong transportation demand.

- Recycled aluminium will accelerate due to ESG goals and circular economy regulations, becoming a bigger part of the overall aluminium supply mix.

- Regional shifts will continue, with China’s dominance softening slightly as India, Southeast Asia, and the GCC emerge as growth hubs.

- Technological innovation in scrap sorting, low-carbon smelting, and green alloys will define the next decade’s winners.

In short, 2025 will not be a zero-sum game. Both primary and recycled aluminium will need to evolve and innovate together, serving distinct but interlinked roles in a rapidly transitioning global economy.

Source: AL Circle estimates

Conclusion

As the aluminium industry marches towards 2025, the competition between primary and recycled aluminium is not about displacement but about adapting to serve different needs in a sustainability-focused era.

Companies that invest smartly—whether in low-carbon primary production, recycling efficiencies, or new product development—will not just survive; they will thrive in a future where sustainability equals competitiveness.

The message is clear: Adapt, innovate, and decarbonise—or risk being left behind.

Discover how the global primary and recycled (secondary) aluminium sectors are striving to lead in their respective arenas of aluminium production and consumption. “Global Primary and Recycled Aluminium Industry Outlook 2025” offers a comprehensive regional analysis, shedding light on production trends, consumption dynamics, and the strategic role of scrap in the primary aluminium sector.

Stay ahead of industry developments and make informed decisions. Subscribe today to access exclusive insights and stay at the forefront of the aluminium industry’s transformation.