As we move through 2025, the upstream aluminium sector — spanning bauxite, alumina, and primary aluminium — is navigating a landscape filled with opportunity, challenges, and transformation.

At AL Circle, we’ve taken a close look at the trends shaping the initial months of 2025, and it’s clear: the upstream aluminium story this year is one of resilience, recalibration, and readiness for the future.

Here’s our take — a reflection on the data and the deeper shifts shaping the industry.

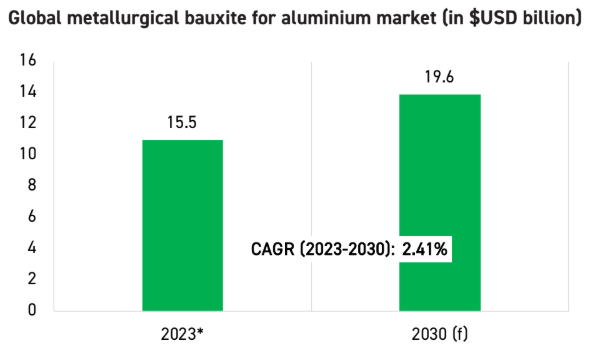

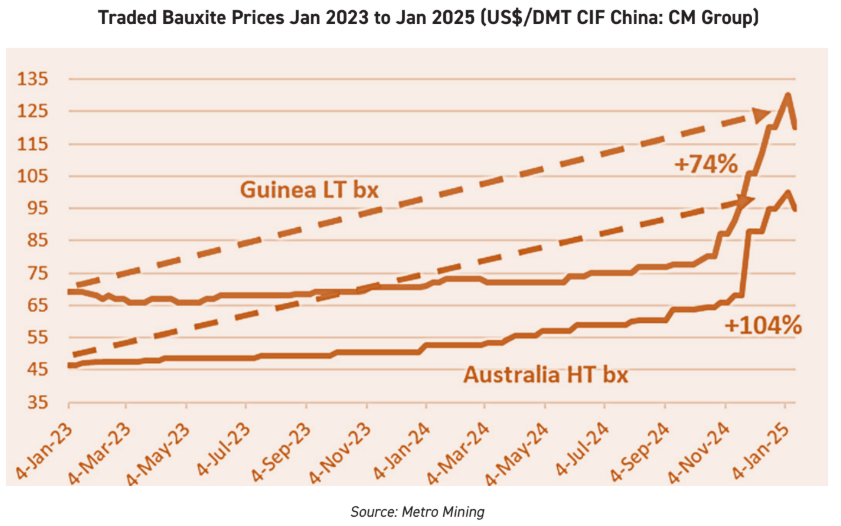

Bauxite: The hero in the shadows at the centre of global supply

In 2025, bauxite continues to play its critical yet often overlooked role. Global production remains robust, driven by strong alumina refining demand, despite logistical challenges and environmental scrutiny.

- Guinea, Australia, India, Brazil, and Indonesia remain the giants in supply. Guinea, in particular, is making headlines with new investments and expanded mining capacities.

- Sustainability has moved from conversation to action. We’re seeing growing commitments to responsible mining practices, land rehabilitation, and community development.

- Pricing has stabilised compared to the volatility of recent years, but geopolitical risks and infrastructure bottlenecks in key regions still cast a shadow over long-term supply security.

Our view?

2025 marks a year where bauxite is no longer just abundant — it’s becoming strategic. Supply chain resilience is now a premium feature, not an afterthought.

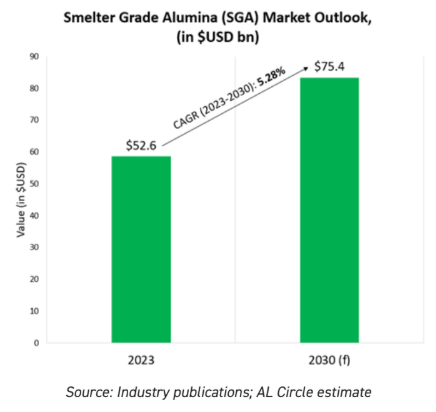

Alumina: Walking the tightrope of supply and demand

- Turning bauxite into alumina — the intermediate step — is proving to be more complex than ever in 2025.

- After a turbulent few years, alumina prices softened slightly in early 2025, offering some breathing space to primary producers. However, the second half of the year could see tightening again, especially with China’s steady downstream demand and supply disruptions in some regions.

- Refineries are facing increasing scrutiny around energy consumption and emissions, prompting new investments in lower-carbon technologies.

Globally, alumina capacity additions are expected to outpace short-term demand growth, leading to modest surpluses in some regions by the end of the year. However, regional imbalances — especially between the Pacific market and the Atlantic market — keep the trading environment dynamic.

Our take?

Alumina is entering a more differentiated market — where low-carbon, responsibly produced material will increasingly command a premium. “Commodity” alumina and “green” alumina are no longer interchangeable.

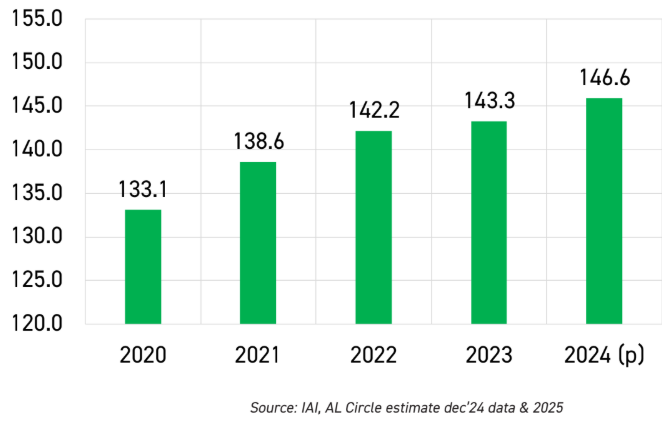

Global alumina production trends and projection, 2020-2025 (in million tonnes)

Primary Aluminium: Defying challenges with steady growth

If there’s a one-star performer in the upstream story of 2025, it’s primary aluminium.

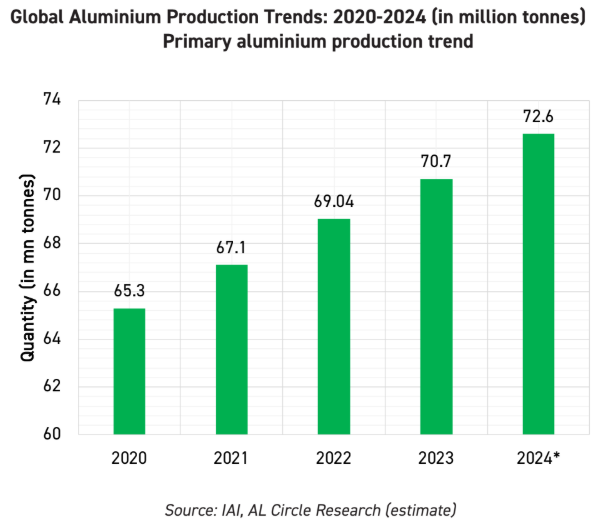

- Global primary aluminium production is on track to exceed the 2024 production figures this year, buoyed by capacity additions in Asia (notably India, ASEAN and the Middle East), even as China hits its production “ceiling.”

- Demand from transportation (especially EVs), renewable energy infrastructure, and packaging sectors remains a key growth engine.

- At the same time, geopolitical tensions, economic deceleration, and environmental regulations continue to squeeze margins and restrain expansion.

Interestingly, the global aluminium market is anticipated to move closer to a deficit towards the end of 2025.

This supply-demand tightness is forecasted to support higher price levels, although the present LME prices reflect a dip.

Our insight?

Primary aluminium in 2025 is no longer just a volume game. It’s about carbon credentials, energy sourcing, and resilient production models.

Low-carbon aluminium is the new gold.

Key themes defining the 2025 upstream landscape

Across bauxite, alumina, and primary aluminium, several defining themes stand out this year:

• Energy transition pressure:

Aluminium’s role in renewable energy is expanding rapidly — from solar frames to grid wiring. But ironically, producing aluminium itself needs an urgent energy transition toward renewables and greener tech.

• Supply chain regionalisation:

More producers are trying to shorten supply chains — investing in regional refining and smelting to minimise shipping costs, tariffs, and carbon emissions.

• Premium on “Green” credentials:

Brands and governments are increasingly demanding low-carbon aluminium. Green-certified upstream operations will see growing market advantages — and possibly pricing premiums.

• China’s evolution:

China’s aluminium growth is stabilising, not stalling. The focus is shifting from “more tonnes” to “better tonnes” — higher quality, lower emissions, and better margins.

- Trade and Geopolitics:

The US tariffs on aluminium imports from the world, sanctions, and regulatory pressures — especially around Russian aluminium — are reshaping trade flows. Expect continued market volatility.

The road ahead: Mid-2025 to beyond

As we move deeper into 2025, it’s clear that the upstream aluminium sector isn’t just weathering change — it’s leading change.

- Bauxite is becoming strategic.

- Alumina is evolving from a commodity to a speciality material.

- Primary aluminium is entering a new premium-driven era.

In our view, 2025 will be remembered as the year the upstream aluminium industry matured — both economically and environmentally.

Those who embrace sustainability, technological innovation, and supply chain resilience will be the winners of this new aluminium age.

At AL Circle, we’ll continue to watch, analyse, and celebrate this transformation — because the best stories in aluminium are only just beginning. Subscribe to the lite version report, “Global Upstream Aluminium Industry Outlook 2025“.

Note: This blog is based on our in-depth review of the “Global Aluminium Industry Outlook 2025” report by AL Circle Research.