Aluminium is a vital material for the energy transition and our daily lives. It is integral for solar panels and wind turbines, electric cables, packaging, and consumer goods. It stands to reason that the industry is one of the most crucial for economic security, resilience, and climate goals.

However, in many countries this sector remains dependent on fossil fuels, which risks price volatility, threatens economic resilience, and entails a large carbon footprint. The aluminium industry is responsible for 1.1 gigatonnes of carbon dioxide (CO2) equivalent of greenhouse gas (GHG) emissions annually. To bolster economic security and resilience and decarbonise, the industry will need significant investment as well as a clear and supportive policy framework. But as there are so many climate dragons to slay, such as road transport or buildings, why should aluminium feature as a top priority for policymakers? This article will outline three business-based reasons to consider aluminium decarbonisation worthy of particular attention.

- Industry competitiveness

Decarbonising the sector by integrating renewable energy into the production process is a win-win solution for policymakers and their domestic aluminium industry. It will lower costs and emissions while enabling the sector to take advantage of the rapidly growing global low-carbon aluminium market and enhance energy security. Aluminium decarbonisation represents a prime opportunity for policymakers to give their domestic industry a competitive edge and demonstrate global leadership, especially given the range of proven policies available to them.

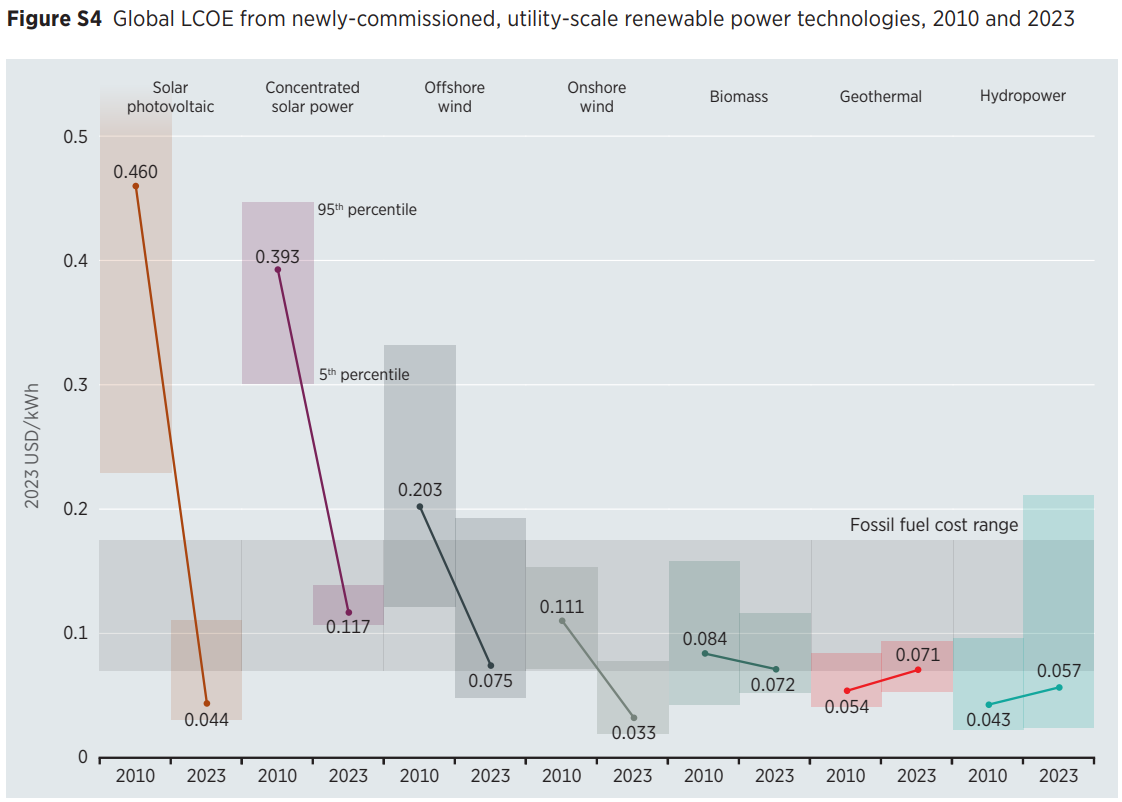

The production process of primary aluminium is hyper electro-intensive. To put it into perspective, the electricity demand of the entire aluminium industry is comparable to that of a country like Japan or Russia. It is therefore no surprise that electricity represents a major cost component of primary aluminium (around 30-40%) and about 2/3 of the emissions of the global value chain. As the costs of renewable energy technologies are breaking record lows (see figure below) and are now serious competitors to fossil-based electricity, the aluminium industry needs to get on board with the renewable energy revolution.

Moreover, some of the lowest-cost aluminium plants (or “smelters”) have already been running on hydropower for decades such as in Canada, or Russia. Since the smelting process requires stable power all year around, the technical challenge for the industry is to accommodate new variable renewable energies. This is made increasingly possible through grid balancing, battery storage and demand-side management practices. Variable renewables (i.e. wind and solar) currently contribute about 4% of the global aluminium electricity supply and are mostly procured through grid power purchase agreements (PPAs).

Global LCOE from newly-commissioned, utility-scale renewable power technologies, 2010 and 2023

(Source: IRENA (2024) – Renewable Power Generation Costs in 2023).

Additionally, small pockets of demand for low-carbon aluminium have started to form. For instance, as of July 2024, 19 corporate members (including Ball Corporation, Volvo Group, Apple) had joined the First Movers Coalition (FMC) aluminium commitment, thereby pledging to procure at least 10% of very low-carbon primary aluminium (< 3tCO2e/tAl) by 2030. Although it has not yet reached sufficient levels to tip the global production to green, aluminium suppliers should remain vigilant and responsive to these signals to ensure not being forced out of the market because of carbon-intensive production. On that note, demand-side policies are critical to accelerate clean industry transformation.

Policy options such as mandates on low-carbon content have been outlined in the Green Demand Policy Playbook published by the Industrial Transition Accelerator (ITA). The introduction of CBAM should also drive demand for lower-carbon aluminium in EU27 and encourage companies exporting to Europe to invest in cleaner production.

By promoting the integration of renewable electricity into the grid and ensuring preferential access of renewable PPAs to aluminium companies, policymakers can lead the way and provide their domestic aluminium industry with a competitive edge within the global market.

This is particularly important given aluminium’s status as a heavily-traded commodity and as demand for greener production is already taking shape.

- Technology leadership

Aluminium decarbonisation requires considerable innovation, providing significant opportunities for industry and policymakers alike. Leading the development of breakthrough technologies will create new commercial opportunities, enhance competitiveness and cut emissions. The scope for technological leadership in this sector and the benefits that come with that make it particularly noteworthy for policymakers.

The aluminium industry is home to many technological innovations under research and development, which all represent potential business opportunities once scaled to commercial viability.

Inert anodes for example could represent a breakthrough from an emissions and economic perspective. About 15% of GHG emissions from the aluminium industry originate from the smelting process itself due to the consumption of carbon anodes. Inert anodes hold the promise of eliminating these emissions along with the operational costs linked to the fabrication of carbon anodes, representing again circa 15% of the production cost.

Three main companies / consortiums are currently leading the race to a commercial-scale inert anode technology: Elysis in Québec (a joint venture between Rio Tinto and Alcoa), Arctus Aluminium in partnership with Trimet in Germany, and Rusal in Russia. As producers of primary aluminium, these companies have a vested interest in mastering inert electrolysis for their own operations first, before the option of selling the technology to competitors.

EnPot is another promising technology that was developed in New Zealand and successfully tested at commercial scale at Trimet’s Essen smelter in Germany. Its purpose is to provide aluminium smelters with a ±30% power flexibility without disturbing the heat balance in the electrolysis cells. Acting as a “virtual battery”, EnPot indirectly facilitates the integration of variable power supply into the grid. The company appears to have progressed to commercial deployment.

Other areas of innovation include scrap sorting and treatment, energy efficiency, operational flexibility, new aluminium alloys, and breakthrough processes. These are pivotal to drive the transition to low-carbon aluminium while enhancing the industry’s competitiveness through cost reductions and higher-quality products. Many of these developments emerge from collaboration between industry and academia, often resulting in the creation of new companies and contributing to a dynamic business ecosystem.

- Supply chain security

Decarbonising the aluminium sector through improving recycling offers myriad benefits for policymakers and industry. Repurposing scrap rather than relying on imported feedstocks will mitigate the risk of supply chain disruptions, bolstering economic security and resilience while also slashing emissions. With aluminium consumers in the EU under significant financial strain due to the consequences of the war in Ukraine, the industry is worthy of particular attention now.

Ensuring a reliable supply of aluminium can prove critical for various segments of the economy. Aluminium is considered an enabler for many clean technologies such as electric cables, solar PV, battery storage and EVs as well as other strategic applications such as defence and aerospace. The EU provides a recent example of the risks caused by supply chain disruptions and high reliance on imports. Since the war breakout in Ukraine, the EU has reduced its dependence on Russian aluminium from 16% in 2020 to 6% in 2024 and compensated with imports from other regions, notably North America and the Middle East. In the same period, five European smelters have been shut down due to skyrocketing electricity prices, largely correlated to the increase in natural gas prices. Half of the EU27 primary capacity was amputated as a result, putting additional financial strain on EU aluminium consumers.

Recycling is a powerful decarbonisation lever that can reduce the risk of supply disruptions. It is already leveraged extensively as it represents 35% of global aluminium production and expected to grow up to around 50% by 2050. Besides having a GHG intensity about 5% that of primary production, secondary aluminium relies on scrap as a feedstock and not on naturally occurring bauxite or alumina for which the production is fairly concentrated geographically. Improving scrap collection and treatment is therefore not only a sound environmental practice, but also serves to secure a fraction of the domestic aluminium supply.

Conclusion

In a nutshell, aluminium has established itself as a cornerstone material in countless modern applications, including various clean technologies. While the climate footprint of its production represents a challenge, it also provides an array of opportunities for policymakers and industry alike:

First off, integrating renewable energy into the production process could provide the sector with a long-term competitive advantage, secure access to emerging green markets and enhance energy security.

There is also a clear opportunity to lead on low-carbon innovation, which would unlock domestic business opportunities and enhance competitiveness while positioning governments and companies as technological champions.

Lastly, improving aluminium recycling would reduce reliance on imported feedstocks, mitigating the risk of supply chain disruptions – improving economic security and resilience while cutting emissions by 95%.