Climate imperatives, resource efficiency, and industrial resilience have positioned secondary aluminium as a critical player in reshaping the global metals landscape. Among the standout performers, China’s meteoric rise in secondary aluminium production serves as both a case study in policy-driven transformation and a harbinger of how circularity can redefine traditional heavy industries.

China: Leading the charge in a circular transition

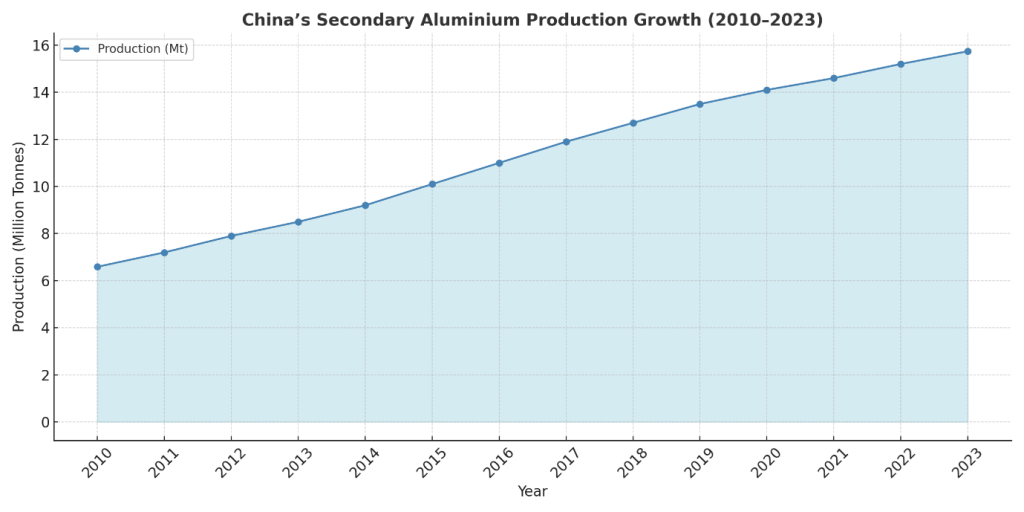

From around six million tonnes in 2010 to more than fifteen million tonnes in 2023, China has more than doubled its secondary aluminium output in just over a decade, now commanding nearly 38-40 per cent of the global total. This impressive trajectory reflects a synergistic blend of industrial demand, environmental urgency, and government policy.

The nation’s burgeoning appetite for aluminium from sectors such as automotive, packaging, and construction has created a robust internal demand loop. More recently, the dual carbon goals outlined in China’s 14th Five-Year Plan have intensified focus on scrap utilisation, green smelting, and closed-loop recycling—cornerstones of the country’s new industrial playbook.

Demand diversification: Beyond traditional ingots

The domestic demand for secondary aluminium reached more than twelve million tonnes in 2024, growing at a 12-13 per cent compound annual growth rate (CAGR) between 2020-2025. While traditional alloy ingots continue to hold the lion’s share of consumption, there’s a decisive shift toward value-added applications.

Particularly, flat-rolled and extruded products have seen notable uptake, driven by increasing demand for remelt billets and wrought alloys—a reflection of China’s evolving industrial base and the rising quality expectations of downstream users.

Mobility-driven demand: NEVs and motorcycles in focus

China’s new energy vehicles (NEVs) sector is a beacon of this new demand. In 2024, the country produced over 10 million NEVs, a staggering 34.4 per cent year-on-year increase, accounting for more than 40 per cent of domestic automotive sales. While internal combustion engine (ICE) vehicles still dominate secondary aluminium usage, NEVs are pushing the envelope, demanding advanced, lighter, and more efficient alloys.

Likewise, motorcycle production remains a stronghold for secondary aluminium. In 2024, China manufactured 19.97 million units, with secondary aluminium consumption in this segment rising 3.4 per cent to 760,000 tonnes. These mobility segments are not only critical from a volume standpoint but also vital to the ongoing shift toward lightweighting and emission reduction.

Policy as a catalyst: From regulation to reinvention

Underpinned by the 14th Five-Year Plan and reinforced by its carbon neutrality roadmap, China’s policy environment has become a decisive lever. Subsidies, infrastructure development, and R&D incentives are supporting innovation-driven recycling, while enterprises relying on outdated tech or tax loopholes are being systematically edged out.

The result is a fast-maturing industry where compliance, technology, and traceability are becoming the new benchmarks of competitiveness in China’s aluminium recycling space.

Global overview: A rising tide across continents

While China sets the pace, Europe and North America remain vital pillars of the global recycling ecosystem. In 2023:

- Europe produced more than five million tonnes, leveraging mature collection systems, Extended Producer Responsibility (EPR) frameworks, and sophisticated sorting technologies.

- North America followed closely, recovering from 2010, driven largely by enhanced automotive recycling and decarbonisation incentives.

However, these regions now face a critical inflection point—upgrading infrastructure and digitising scrap traceability are no longer optional but essential for maintaining global competitiveness and meeting stringent low-carbon manufacturing standards.

Asia beyond China: Growth amidst gaps

Other Asian countries, excluding China and Japan, have recorded a remarkable jump—from two million tonnes in 2010 to more than seven million tonnes in 2023. Southeast Asia, India, and South Korea have led this surge, propelled by industrialisation and manufacturing exports.

Yet, critical infrastructure gaps—especially in standardised scrap collection and contamination control—are hampering quality and consistency. Bridging these gaps will determine whether the region can scale sustainably while aligning with emissions and quality norms demanded by global markets.

Middle East and South America: Strategic shifts and steady progress

The Middle East, traditionally dominated by primary aluminium production, has begun pivoting. Since 2010, its recycling ingot output has grown substantially in 2023, signalling a shift toward localisation, diversification, and carbon-conscious manufacturing.

Similarly, South America is on a path of steady progress. Its output rose from 1.25 million tonnes in 2010 to 1.94 million tonnes in 2023, backed by expanding urban recovery networks and rising policy interest in sustainable material flows.

The road ahead: Circularity as the new competitive edge

As demand for low-carbon materials, particularly aluminium, accelerates across sectors, secondary aluminium will be central to decarbonising global supply chains. China’s example offers valuable lessons: how policy alignment, technological modernisation, and diversified demand can turn recycling into a growth engine.

But the challenge is far from over. Globally, countries must invest in digitalisation, automation, contamination control, and closed-loop systems to ensure supply reliability, environmental integrity, and industrial scalability.

In this race toward sustainable industrialisation, secondary aluminium is no longer just a supplement—it’s a strategic imperative.

For those seeking a deeper understanding backed by robust data, regional scrap demand insights, and comprehensive trade analysis, the AL Circle report “World Recycled Aluminium Market Analysis – Industry Forecast to 2032” offers a valuable resource. It brings together detailed market intelligence to support informed decision-making in the evolving landscape of secondary aluminium.