The aluminium extrusion market has evolved into one of the most dynamic segments of the global metals industry, serving as a critical enabler of the world’s transition toward a low-carbon and technology-driven economy. From electric mobility to renewable energy and sustainable infrastructure, aluminium extrusions have become the backbone of modern innovation, lightweight, durable and infinitely recyclable.

Global market trends: A growing appetite for sustainability

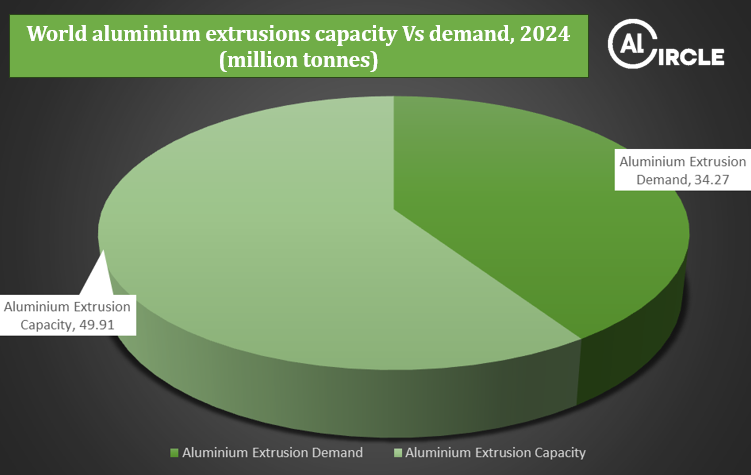

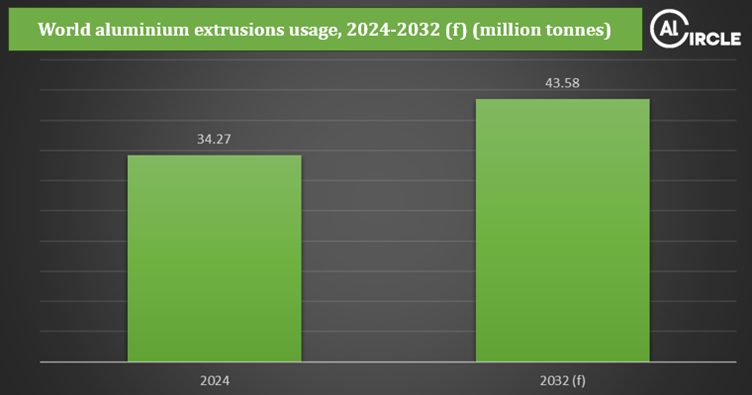

In 2024, global aluminium extrusion demand is estimated at 34.27 million tonnes, reflecting a strong recovery after pandemic-induced disruptions. The industry’s resurgence is powered by growing environmental awareness and the push for decarbonisation across major sectors such as transportation, construction, energy and packaging.

Lightweight aluminium extrusions are increasingly favoured in electric vehicles (EVs) and mobility solutions to improve efficiency and extend range. The renewable energy sector, spanning solar panels, wind turbines and battery storage is also driving robust demand. Moreover, sustainable packaging applications are surging as aluminium cans and foils replace single-use plastics in the food, beverage and pharmaceutical industries.

Meanwhile, emerging trends in smart cities, aerospace, healthcare, and digital infrastructure are opening new frontiers for extrusion products. These structural transformations are cementing aluminium’s role as the metal of the future, central to global climate goals and industrial innovation.

China market analysis: From expansion to transformation

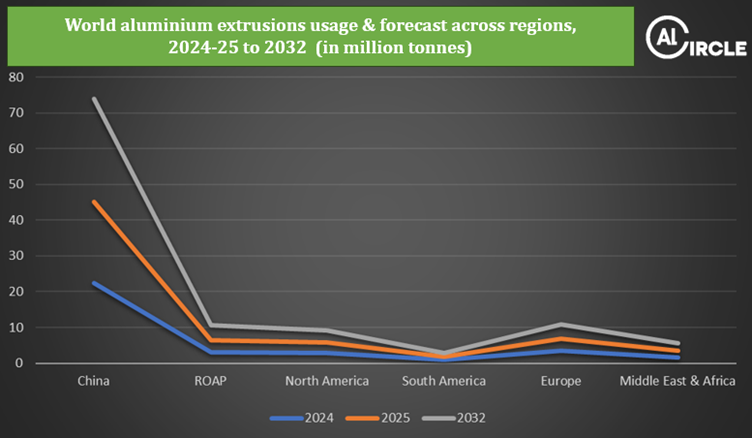

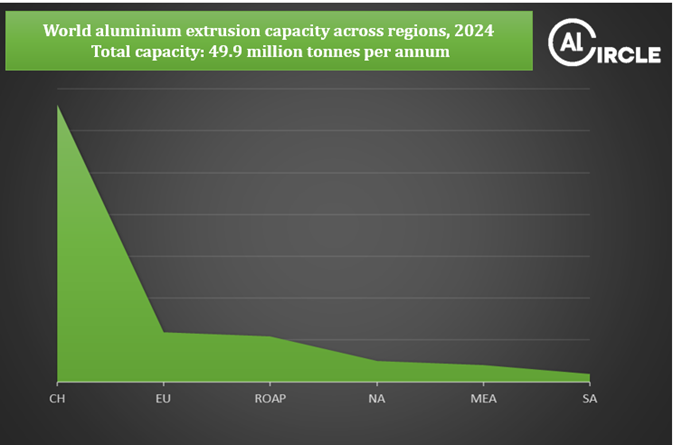

China remains the powerhouse of the global aluminium extrusion market, accounting for approximately 66 per cent of global capacity, around 32.94 million tonnes out of the world’s total 49.91 million tonnes per annum. However, the next phase of growth in China is expected to shift from rapid expansion to industrial upgrading.

Source: AL Circle Research

Under its 45 million tonnes cap on primary aluminium, China’s production is nearing maximum utilisation, suggesting that future gains will come from efficiency improvements, recycling and green production rather than capacity additions. Domestic consumption continues to expand, supported by new energy vehicles (NEVs), solar energy installations and infrastructure development.

Source: AL Circle Research

Chinese extruders are also investing heavily in “green billets” billets produced from renewable energy or post-consumer scrap, as part of the nation’s broader carbon neutrality objectives. The move aligns with global sustainability trends and enhances China’s competitiveness in international markets increasingly governed by carbon-related trade policies.

Competitive landscape analysis: A market in transition

Globally, the aluminium extrusion industry is fragmented, with over 1,600 companies operating across major regions. While large integrated players dominate in Asia and Europe, smaller specialised extruders are carving out niches in high-value sectors such as aerospace, electronics, and precision engineering.

Competition is intensifying as extruders adopt larger, more advanced presses to improve productivity and expand market share in value-added segments. Companies are differentiating themselves through innovation in alloy design, surface treatments and digitalised manufacturing processes that enhance efficiency and quality.

At the same time, energy costs, though stabilised since the crisis years, remain structurally high and uneven across regions, influencing cost structures and trade competitiveness. This underscores the need for companies to invest in energy-efficient operations and recycling systems to maintain profitability and sustainability.

Forecast market trends: Growth with green priorities

Looking ahead, aluminium extrusion demand is projected to grow at a CAGR of 3.05 per cent, reaching nearly 43.58 million tonnes by 2032. Growth will be propelled by the global pivot toward clean energy, lightweight transportation, and green construction, even as traditional construction demand moderates in mature economies.

However, geopolitical uncertainties and uneven regional growth may continue to challenge market stability. For industry stakeholders, agility, digital transformation, and circularity will be the cornerstones of resilience and growth.

In essence, while global capacity expansion is slowing, the value proposition of aluminium extrusions as a sustainable, adaptable, and high-performance material has never been stronger. The next decade will belong to those who combine innovation with sustainability, harnessing new technologies and green practices to lead in the evolving landscape of the aluminium extrusion market.