The Global Aluminium Industry Outlook 2026 points to a market that is no longer driven merely by capacity additions or price cycles, but by how intelligently demand is created, shaped and sustained. According to leading market size reports, aluminium remains one of the most structurally important base metals, with consumption deeply embedded across transportation, construction, packaging, energy and industrial machinery. While upstream supply dynamics continue to attract attention, it is the downstream sector that truly defines the industry’s trajectory, because this is where aluminium is transformed from metal into value.

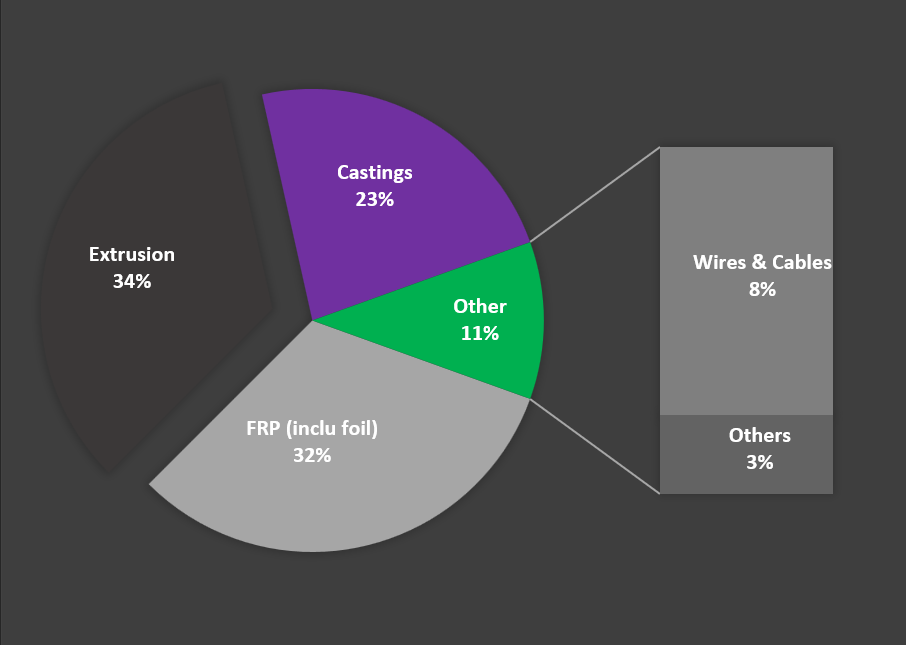

The global aluminium downstream market in 2025 witnessed steady, moderate growth, with extrusions accounting for about 34% of total consumption. Flat-rolled products, including foil, follow at roughly 32%, supported by strong demand from the packaging, transportation and industrial sectors.

Global aluminium downstream usage, 2025 (Consumption: 104.01 million tonnes)

Source: AL Circle Research

One of the clearest indicators of this demand-led reality is aluminium casting. Aluminium castings account for nearly 23% of global aluminium usage, underpinned by automotive powertrains, EV platforms, industrial machinery and engineered components. Even as internal combustion engines gradually give way to electrification, cast aluminium remains indispensable due to its strength-to-weight ratio, thermal performance and design flexibility. Together with rolled and extruded products, casting reinforces a stable downstream landscape, one supported by broad industrial activity and the continued substitution of heavier or less sustainable materials with aluminium.

From a regional perspective, market trend research suggests that 2026 will remain positive overall, but uneven. Emerging and developing economies continue to drive incremental demand through infrastructure build-out, manufacturing expansion and urbanisation. However, some mature regions particularly North America, major European economies, are encountering demand-side friction and China is expected to see slowdown in the exports of semi-finished products. High interest rates, cautious capital expenditure, energy cost volatility and slower automotive production have introduced short-term headwinds. These are not structural weaknesses, but cyclical pauses that highlight the importance of diversified downstream exposure rather than reliance on a single end-use sector.

Understanding the aluminium value chain is essential to reading the 2026 outlook correctly. The downstream sector is the heart of the value chain, because it generates real demand. The upstream sector bauxite, alumina and primary smelting, controls supply dynamics and cost structures. The end-user sector represents the final consumption bucket, where aluminium competes with steel, plastics, composites and emerging materials. When downstream industries are strong, upstream supply finds purpose; when they weaken, excess capacity quickly becomes a burden. This balance will define pricing discipline and investment decisions through 2026.

Industrially, the downstream aluminium sector forms the backbone of modern manufacturing. It supplies critical inputs to automotive, construction, packaging, aerospace, electronics, renewable energy and industrial machinery. Its importance lies not just in volume, but in functionality, light-weighting for fuel efficiency and EV range, corrosion resistance for infrastructure longevity, conductivity for power and electronics and design flexibility for advanced engineering. As industries chase efficiency, performance, and emissions reduction, aluminium’s downstream applications become less optional and more strategic.

From a strategic lens, downstream aluminium is where innovation happens and where long-term demand is secured. It enables advanced alloys, EV battery housings, structural castings, heat exchangers, solar frames, wind components and circular packaging solutions. It also anchors recycling ecosystems and closed-loop material flows, turning sustainability into a competitive advantage rather than a compliance exercise. Countries and companies that invest in downstream capacity are not just expanding production, they are strengthening industrial self-reliance, improving manufacturers’ marketing positioning and transforming aluminium from a traded commodity into a strategic industrial capability.

As 2026 approaches, the message from the Global Aluminium Industry Outlook is clear: growth will not be uniform, but it will be intentional. Those who understand downstream demand signals, align supply accordingly and communicate value through data-driven market size reports and market trend research will outperform. In aluminium, the future belongs not to those who simply produce more metal, but to those who know precisely where, how and why it will be used.

It’s interesting how the aluminium industry is shifting from price cycles to demand-driven growth, especially in downstream sectors. With sectors like transportation and packaging relying so heavily on aluminium, I can see why downstream trends will increasingly shape the market.