In an era of rapid structural change across commodity markets, AL Circle’s “Global Aluminium Industry Outlook 2026” stands apart as more than a broad forecast; it’s a competitive analysis market research tool designed to guide industry leaders, investors, and policymakers through complexity with rigorous data, regional depth and forward-looking clarity. Unlike many general reports, this Outlook integrates macroeconomic conditions, competitive landscape analysis, production and demand dynamics and structural shifts shaping the industry through 2026 and beyond.

At its core, the report provides region-wise insights into production and demand across the entire aluminium value chain, from bauxite mining and alumina refining to primary and secondary metal production, downstream consumption, trade flows and sustainability trajectories. This multi-layered approach ensures that strategic decisions aren’t based on isolated numbers but on holistic market intelligence that reflects real-world competitive pressures and opportunities.

What makes this report different?

Integrated value-chain coverage

Most industry outlooks focus narrowly on either production or downstream demand. AL Circle’s Outlook spans upstream, midstream, and downstream segments, providing a complete picture from bauxite supply trends to recycled aluminium dynamics. This enables stakeholders to evaluate not only what markets will grow, but why they will grow and how value shifts across sectors.

Region-wise & major country-wise production & demand context

The report delivers deep analysis for key geographic regions, Asia (including China & India), Europe, North America, South America, Oceania and the Middle East & Africa, highlighting regional supply/demand balances, growth drivers, risks and competitive positioning.

- Asia Pacific / China & India: Asia remains the dominant centre of global aluminium demand and production. China alone accounts for roughly 60% of global primary aluminium output and hosts significant export and regional supply chains. India is rapidly increasing its capacity and demand, driven by the growth of its infrastructure and automotive markets.

- North America: Demand is anchored in transportation, packaging, and renewable energy infrastructure, with increasing adoption of recycled aluminium in line with sustainability goals.

- Europe: Stringent carbon policy and high energy costs are reshaping competitiveness, pressing producers toward low-carbon and circular production pathways.

- South America & MEA: Emerging supply and bauxite exports (notably from Guinea) support production expansion, while Middle Eastern regions leverage cost-effective energy and downstream diversification opportunities.

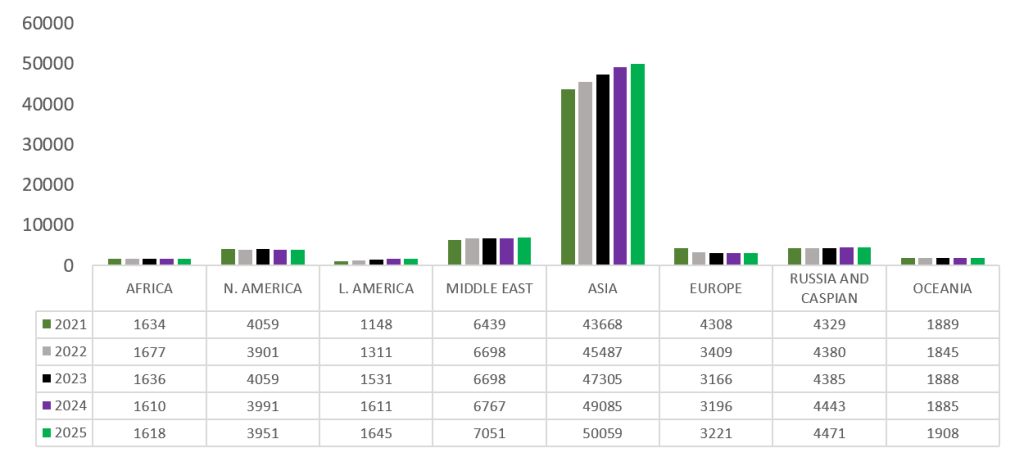

Region-wise primary aluminium production, 2021-2025 (p*) (000 tonnes)

Source: AL Circle Research; Company Financials

*p = Preliminary estimate

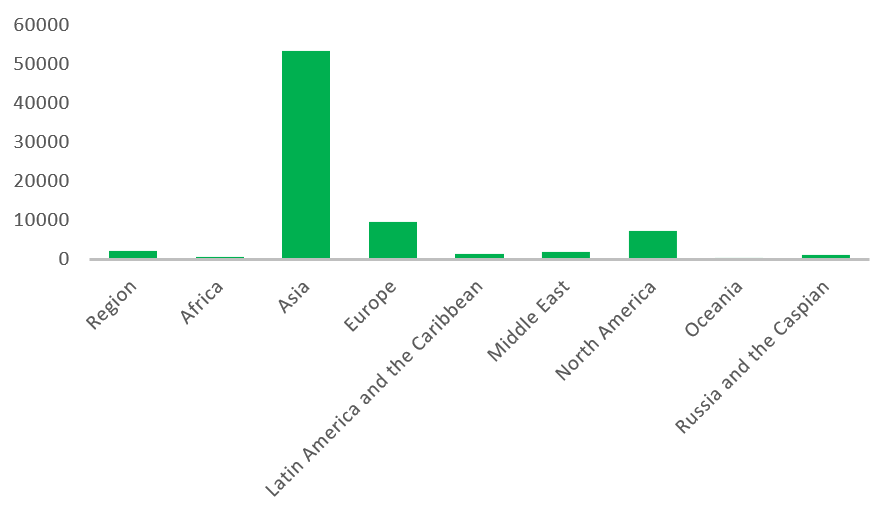

Region-wise primary aluminium demand 2026 (f) (in 000 tonnes)

Source: AL Circle Research

Competitive landscape and market intelligence

Beyond static forecasts, the Outlook offers competitive landscape analysis, profiling key players, capacity expansions, technological shifts and strategic positioning across regions. This allows users to benchmark performance, anticipate competitor moves and plan capacity or investment decisions proactively.

Future market trends & structural shifts

The aluminium industry is no longer defined solely by cyclical demand; it’s being reshaped by sustainability imperatives, energy transitions, electrification and recycling momentum. The report maps out how these trends interplay with macroeconomic signals to shape demand curves, cost structures and trade flows through 2026 and beyond.

Why continuous updates matter

Given the rapidly evolving global economy and policy landscape (e.g., carbon border adjustment mechanisms, energy costs, geopolitical disruptions), static reports quickly lose relevance. That’s why AL Circle provides updated versions for purchasers along with mid-year updates to capture emerging dynamics, turning a one-off purchase into a continuously relevant resource for strategic planning.

This continuity ensures that businesses stay on top of competitive pressures, market disruptions, pricing shifts and region-specific demand signals, enabling informed decisions rather than reactive ones.

Conclusion

In sum, the Global Aluminium Industry Outlook 2026 isn’t just a forecast; it’s a strategic market research asset that integrates competitive landscape analysis, regional production and demand data and future market trends to empower stakeholders to navigate uncertainty and capture growth opportunities in the evolving aluminium world.