In an age of conscious consumption, smart packaging, and high-performance materials, aluminium foil has emerged as more than just a household staple—it’s a silent enabler of some of the most dynamic shifts in global industries.

Our deep dive into the aluminium foil market between now and 2028 reveals a landscape in flux: redefined by sustainability mandates, transformed by EV battery innovations, and reenergised by consumer behaviour. The numbers don’t just indicate growth—they suggest evolution.

The foil effect: Where function meets forecast

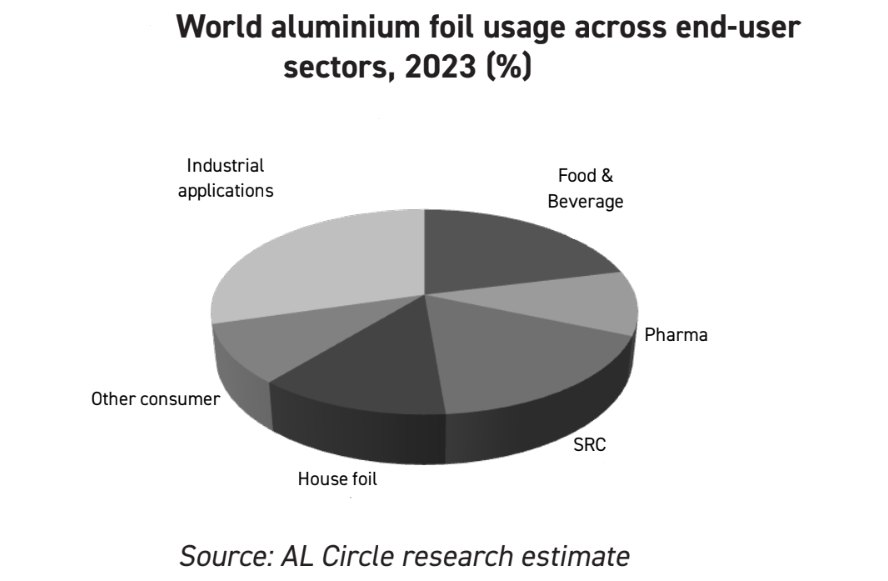

Aluminium foil has carved out its role in several high-growth sectors—from food and beverage to electric mobility. And yet, what’s most intriguing is how its use is evolving.

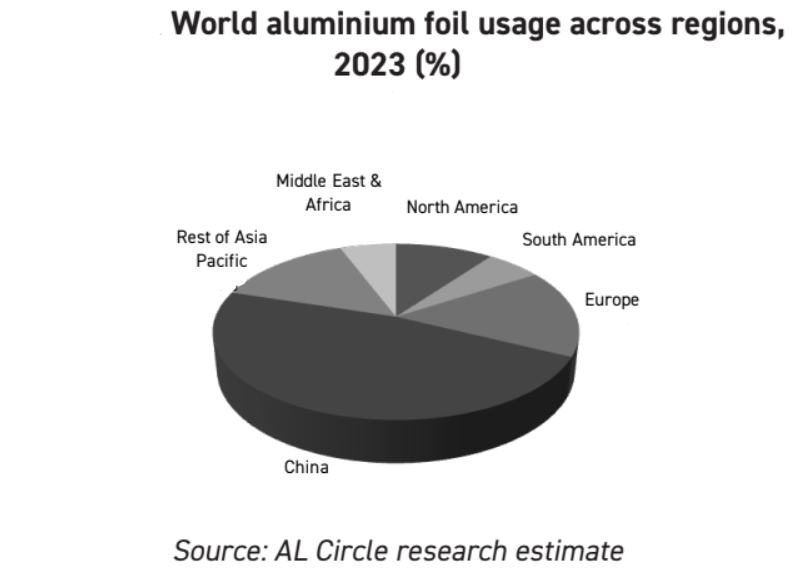

Globally, the aluminium foil market is forecast to expand significantly across multiple regions, with demand expected to rise from both traditional segments like packaging and newer high-growth sectors such as lithium-ion batteries. Between 2023-2028, Asia-Pacific continues to dominate consumption, yet regions like the Middle East & Africa and Latin America are fast catching up—suggesting a broader redistribution of industrial capacities.

This is more than a geographical expansion—it’s a story of shifting consumer priorities and manufacturing footprints. Knowing where, how, and why this shift is occurring can be a competitive edge.

Battery-grade foil: The quiet backbone of EV growth

One of the standout revelations? The growing importance of aluminium foil in energy storage, particularly lithium-ion batteries. As automotive OEMs and tech giants scale up EV and ESS deployments, they increasingly rely on high-spec aluminium foils for cathodes. The result is a spike in demand for ultra-clean, high-uniformity foil—where even microscopic flaws are unacceptable.

Foil manufacturers who pivot early to meet these technical standards stand to benefit enormously. There is a clear window of opportunity here—and it won’t remain open for long.

Sustainability pressure is reshaping the packaging equation

The packaging industry remains the largest end-user of aluminium foil, but sustainability mandates are redefining what’s viable. Single-use plastics are in decline. Circular economy strategies are pushing brands toward recyclable and lightweight materials. And aluminium foil, with its barrier properties and infinitely recyclable nature, is emerging as a go-to solution.

But not all foil is created equal. This report highlights regional differences in alloy compositions, thickness ranges, and coating preferences—vital intelligence for converters, brand owners, and regulatory bodies alike.

Geographies of growth: Not all markets are equal

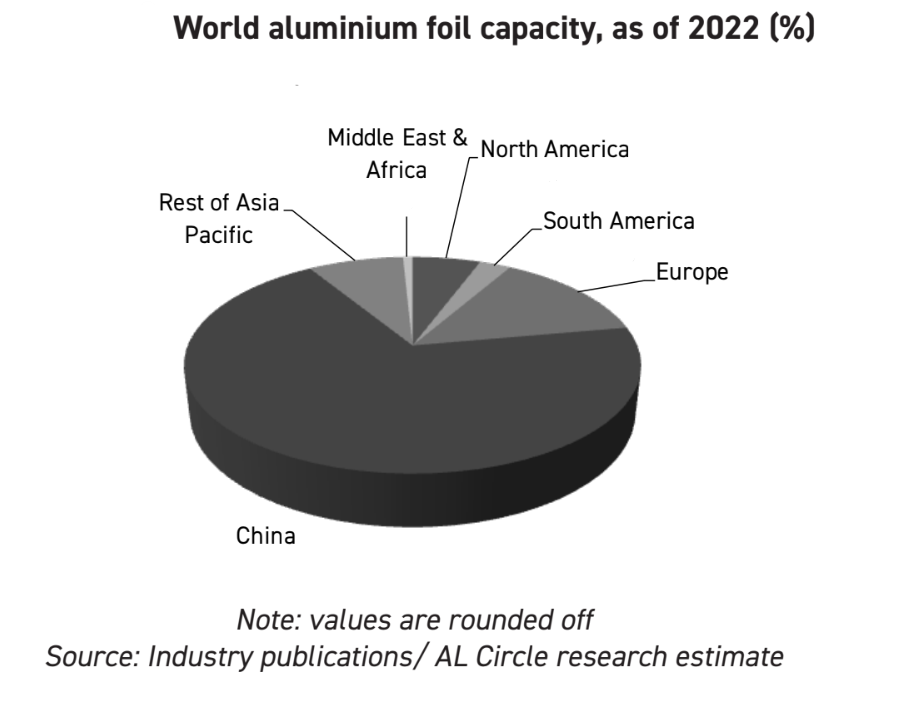

China is the world’s largest producer, consumer, and exporter of aluminium foil, but Europe, the Rest of Asia-Pacific, North America, South America, the Middle East, and Africa show the strongest growth potential. Countries in these regions are not just scaling imports—they’re building domestic production and integrating foil into automotive, construction, and pharma supply chains.

Understanding where capacity is being added, which trade routes are shifting, and what end-use sectors are gaining traction allows decision-makers to calibrate strategy with precision.

Why this report is not just informative—it’s transformational

Whether you’re a foil producer, a buyer from the pharma or FMCG sector, or a stakeholder in electric mobility, this report provides granular forecasts, regional deep dives, end-use insights, and trade analytics that are difficult to find elsewhere.

Some highlights include:

- Global aluminium foil usage forecast by region and sector, till 2028

- Supply chain analysis and production capacity trends

- Trade flows and key exporter-importer relationships

- Segment-specific insights on packaging, insulation, batteries, and more

- Competitive intelligence on leading foil manufacturers across geographies

- Each page is designed not just to inform, but to enable strategy.

Final thought: The foil is thinner, but the opportunity is thicker

If you’ve thought of aluminium foil as a commodity, it’s time to take a second look. The forces of sustainability, energy storage, and global trade realignment are transforming the foil segment into a hotspot for innovation and investment.

The most valuable asset in this evolving market isn’t foil itself—it’s clarity. This report delivers exactly that.

Ready to stay ahead of the curve?

Tap into this timely market intelligence to power your next move.

Get your access to “Aluminium Foil and its End Uses – Current Trends and Forecast till 2028” now.