In a world racing towards decarbonisation and electrification, few materials have proven as versatile, resilient, and strategically vital as aluminium. But behind this shimmering metal lies a silent powerhouse—bauxite and alumina. As we are towards the middle of 2025, the stage is set for transformative shifts across the entire aluminium value chain, with bauxite and alumina standing at the very heart of it all.

The “Global Bauxite and Alumina Industry Outlook 2025” report unpacks these shifts with surgical precision. But more than just data, it offers a rare lens into where the market is headed—and why the real action starts long before the molten metal is poured.

The global momentum: Why 2025 is not just another year

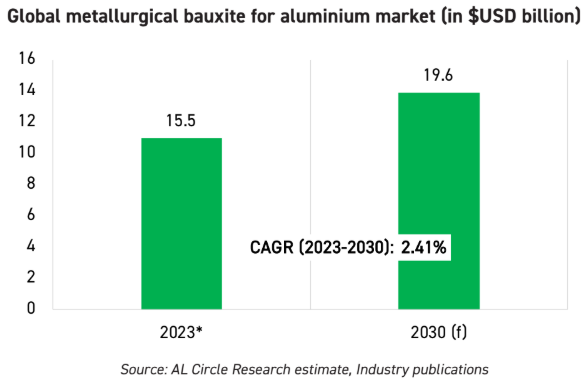

2025 is not just a milestone; it’s a pivot point. With aluminium demand forecasted to climb steadily by 2030, backed by a robust ecosystem surrounding it must evolve to keep pace. From EVs to solar panels, from skyscrapers to soda cans—every sector’s thirst for aluminium is growing. And what feeds this surge? Bauxite and alumina.

Bauxite, the primary ore of aluminium, and alumina, the intermediate refined product, are no longer just “commodities.” They’re strategic assets.

Bauxite: The bedrock of aluminium’s ascent

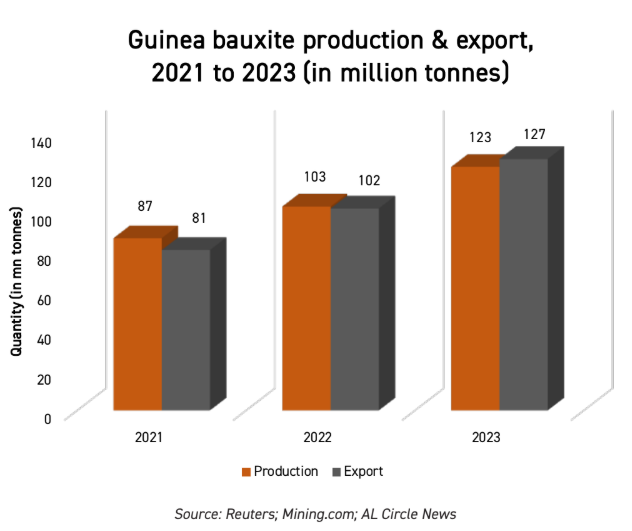

The report reveals that global bauxite production is expected to maintain upward momentum through 2030, with major producers like Guinea, Australia, China, India, Brazil and Indonesia dominating output. But it’s not just about how much we mine—it’s about how we mine. Sustainability developments, investments in green extraction technologies, and evolving trade dynamics are rewriting the rulebook.

A case in point: the bauxite industry is increasingly grappling with geopolitical challenges, logistical constraints, and environmental scrutiny. The demand-supply balance is tightening, with certain key players—particularly in Asia and West Africa—emerging as supply chain linchpins.

What makes this even more complex? The global bauxite trade is becoming more strategic, with countries securing long-term access through joint ventures, infrastructure investments, and, in some cases, export restrictions to fuel their aluminium growth.

Alumina: The crucial middle act

Once bauxite is extracted, the next challenge is refining it into alumina—a process that’s energy-intensive, often carbon-heavy, and vulnerable to market shocks. Yet, the alumina segment is undergoing its own revolution.

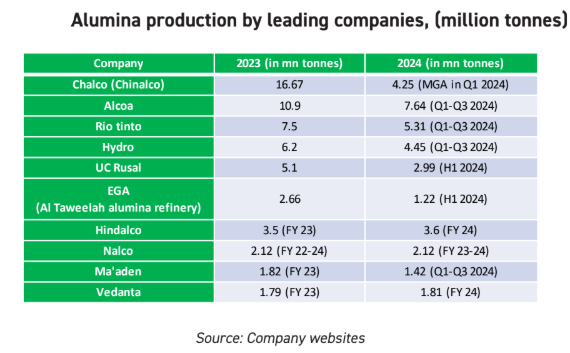

In 2025, world alumina production is expected to continue its gradual rise, powered by expansions in China, India, and Indonesia, along with promising new capacity in the Middle East and Southeast Asia.

This growth is matched by deep structural changes:

- Sustainability initiatives are leading refiners to adopt alternative fuels and cleaner technologies.

- Price volatility, tied to energy markets and raw material shortages, is driving new risk strategies across supply chains.

- Global trade shifts, especially in Asia-Pacific, are influencing where and how alumina is produced, traded, and consumed.

These aren’t just statistics. They represent critical pressure points for every aluminium stakeholder—from traders to manufacturers, investors to policy-makers.

Energy, Trade, and Tech: The forces reshaping the game

The report outlines how energy transition efforts—particularly decarbonisation in aluminium refining—will be a defining trend in the next five years. Companies are being nudged (and sometimes pushed) to lower their carbon footprints across the bauxite-to-aluminium chain.

Add to this a layer of uncertainty: the global energy crisis, exacerbated by geopolitical tensions and inflationary pressures, is reshaping cost structures and investment priorities.

Meanwhile, the trade landscape is anything but static. Export bans, regional tariffs, and localisation efforts are creating a new set of winners and losers. Navigating this shifting terrain will require more than agility—it’ll require foresight.

Who’s investing and who’s innovating?

What sets this report apart is its ability to connect macroeconomic drivers with granular data. For instance:

- Which companies are making breakthrough sustainability investments?

- What are the upcoming mining projects that could reshape regional balances?

- Where are supply gaps likely to emerge—and how can companies get ahead of them?

It even goes a step further, offering a short-medium-and long-term outlook, empowering stakeholders to make not just reactive decisions, but strategic ones.

Why this report matters (more than ever)

In an industry that is vast, where upstream decisions cascade all the way down to consumer products, knowledge is more than power—it’s leverage. The Global Bauxite and Alumina Industry Outlook 2025 is your key to understanding:

- Where the bottlenecks are

- Who’s leading the innovation race

- Which markets are ripe for opportunity—or risk

- What’s the price forecast

It’s more than a snapshot. It’s a navigational chart for a sector on the cusp of reinvention.

Final thoughts: It starts at the source

If you’re in aluminium, you’re in bauxite and alumina—whether you realise it or not. Understanding this upstream segment is essential for strategic planning, risk mitigation, and growth positioning.

2025 won’t wait. The smart players are already adapting. Are you?

Want to stay ahead of the curve?

Unlock deeper insights, forecasts, company profiles, and exclusive market intelligence by subscribing to the “Global Bauxite and Alumina Industry Outlook 2025“ report. The future of aluminium starts here.