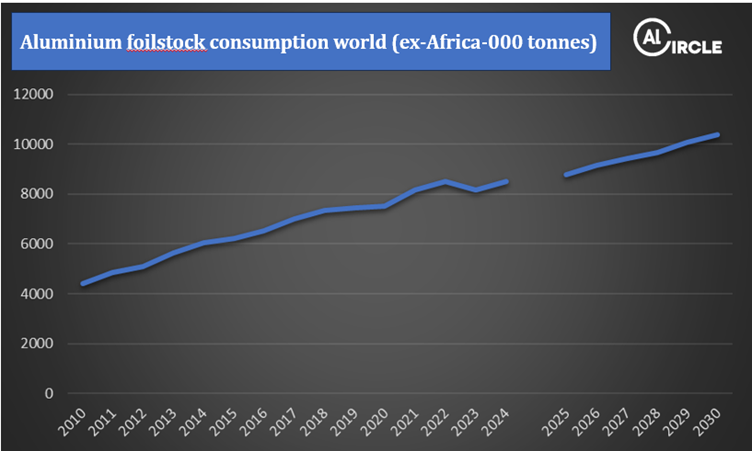

The global aluminium foilstock consumption has experienced steady growth from 4.42 million tonnes in 2010 to 8.18 million tonnes in 2023, registering an 85 per cent increase over 13 years. Despite a marginal decline in 2023 due to weaker North American demand, the overall trend remains strongly upward. This growth underscores the importance of business market research and consumer trends reports in understanding evolving demand patterns and regional dynamics.

Source: AL Circle Research

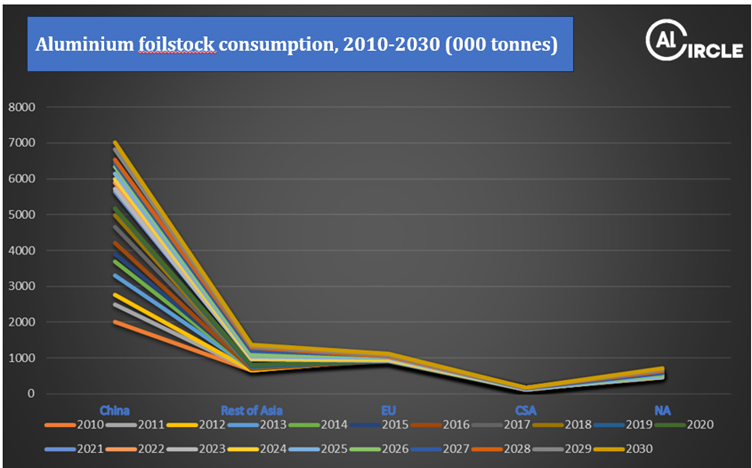

Key market highlights for foil stocks:

- China market analysis : China remains the largest consumer, with consumption projected to rise from 2 million tonnes in 2010 to an estimated 7.0 million tonnes by 2030. This makes China a critical focus market for aluminium foilstock manufacturers and investors.

- Rest of Asia: The region is expected to expand rapidly, with consumption increasing from 659 thousand tonnes in 2010 to 1.36 million tonnes in 2030. Growth is largely driven by industrialisation and the booming packaging sector, highlighting opportunities revealed by segmentation market research.

- European Union (EU): Consumption is expected to rebound modestly, from 928 thousand tonnes in 2013 to 1.11 million tonnes by 2030, showing signs of recovery post-2023. EU trends reflect moderate but stable market potential for targeted product strategies.

- North America (NA): The region experienced fluctuations, with volumes declining from 599 thousand tonnes in 2010 to 451 thousand tonnes in 2023. However, a turnaround is projected, reaching 716 thousand tonnes by 2030, indicating renewed market potential for aluminium foil applications.

- Central and South America (CSA): Demand remained relatively stable, ranging between 121–173 thousand tonnes historically and in forecast periods, suggesting a steady niche market.

Source: AL Circle Research

Outlook to 2030

Total foilstock consumption is forecasted to reach 10.38 million tonnes by 2030, reflecting a CAGR of 3.46 per cent from 2023 onward. China and the wider Asian region will continue to drive growth, while developed regions are anticipated to experience stable to moderate demand recovery, particularly in packaging and household applications. Insights from business market research, China market analysis and consumer trends reports will be essential for stakeholders seeking to navigate opportunities across regional and segmented markets.