Aluminium is no longer just a widely consumed base metal; it is fast becoming a strategic material shaping the future of industrial development. As urbanisation accelerates and industrialisation deepens across emerging and developing economies, aluminium’s relevance continues to expand. Its versatility, spanning transportation, packaging, construction, electrical systems and renewable energy, positions it at the centre of global material transition narratives. An integrated industry market analysis reveals that aluminium’s value chain, spanning from bauxite mining to aluminium recycling, is becoming increasingly interconnected, data-driven, and sustainability-focused as the industry enters 2026.

Market size, growth momentum and demand drivers

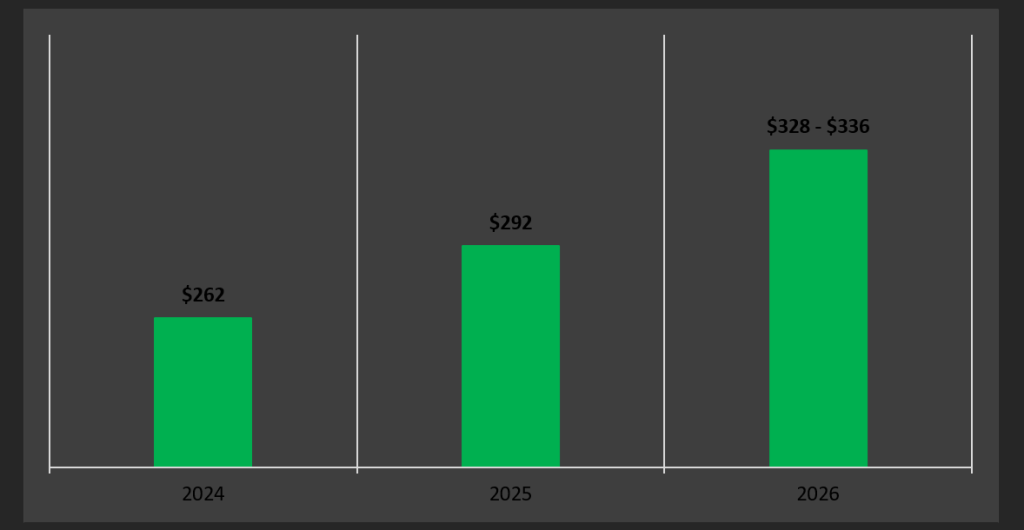

Market data analysis indicates that the global aluminium market is on a strong growth trajectory, with market size projected at USD 328-336 billion by the end of 2026.

Global aluminium market size, 2024-2026(f) (in USD$ Billion)

Source: AL Circle Research; IAI

The anticipated CAGR of around 11.9% between 2024 and 2026 reflects robust demand across automotive, construction, packaging and electrical sectors. Among these, automotive stands out as a critical growth engine. Lightweighting has become a structural priority for vehicle manufacturers seeking to improve fuel efficiency, extend the range of electric vehicles and comply with increasingly stringent emission norms. Market intelligence analysis confirms that aluminium-intensive vehicle platforms are no longer niche; they are becoming the industry standard.

Beyond automotive, construction demand remains resilient, supported by infrastructure investment, urban housing needs, and energy-efficient building standards. Packaging continues to benefit from aluminium’s recyclability and barrier properties, while electrical and power applications are expanding rapidly due to grid modernisation and electrification initiatives.

Together, these sectors provide a diversified and resilient demand base, reducing the industry’s dependence on any single end-use market.

Supply constraints and price fundamentals

From a market trend research perspective, aluminium enters 2026 with some of the strongest fundamentals seen in recent cycles. Global inventories are at multi-year lows, while new primary production capacity remains limited due to high capital costs, energy constraints and environmental permitting challenges. This tight supply backdrop has kept the market structurally constrained, even as demand continues to rise. As prices approached the upper end of the 2025 trading range, questions emerged about sustainability, but industry market analysis suggests the momentum is well supported.

Unlike earlier cycles driven largely by short-term economic rebounds, today’s aluminium demand is increasingly structural. Electric vehicles require significantly more aluminium than internal combustion vehicles, renewable energy systems depend heavily on aluminium components, and power grids are being expanded and upgraded worldwide. These factors collectively underpin demand growth through 2026 and beyond, creating favourable pricing conditions for producers and investors alike.

Consumption outlook and structural demand shift

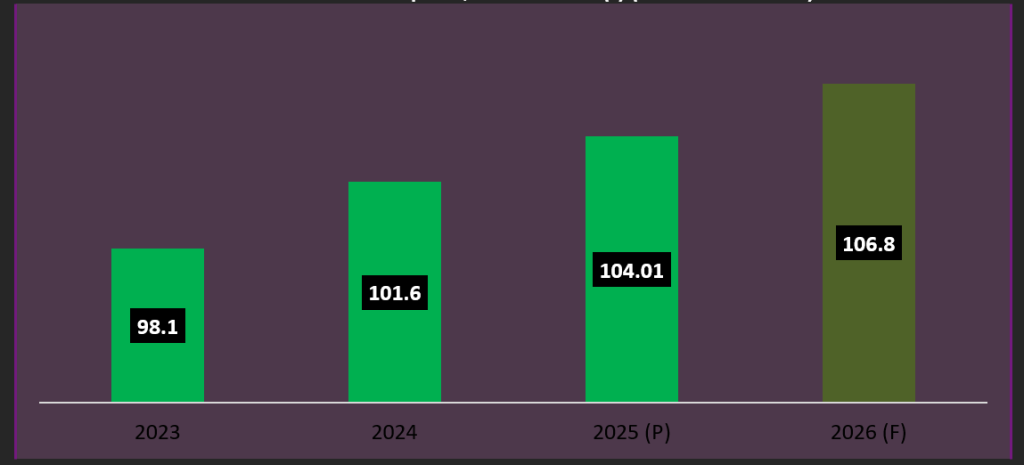

Market data analysis projects global aluminium consumption rising from 101.6 million tonnes in 2024 to 104.0 million tonnes in 2025 (provisional) and reaching approximately 106.8 million tonnes by 2026 (forecast).

Global aluminium consumption, 2023 – 2026 (f) (in million tonnes)

Source: AL Circle Research; IAI

This steady increase reflects not only volume growth but also a qualitative shift in how aluminium is used. The metal is increasingly embedded in long-life infrastructure and clean-energy systems, making demand less volatile and more predictable over the medium term.

This structural shift has important implications for the entire value chain, from bauxite and alumina producers to smelters, fabricators and recyclers. Integrated market intelligence analysis highlights that players who align capacity planning, technology investment and sustainability strategies with these long-term trends are best positioned to capture value in the coming years.

Sustainability, recycling and consumer influence

One of the most powerful trends reshaping the aluminium industry is sustainability. Consumers—particularly younger generations—are increasingly prioritising brands that demonstrate environmental and social responsibility. Market trend research shows that many are willing to pay a premium for products with lower carbon footprints and higher recycled content. For aluminium, this creates a dual dynamic: rising demand for sustainable products, alongside mounting pressure to decarbonise production.

Recycling sits at the heart of this transition. Secondary aluminium requires only a fraction of the energy used in primary production, making it a critical lever for emissions reduction. However, scaling recycling also brings challenges, including scrap availability, quality control, and investment in advanced sorting and remelting technologies. Industry market analysis suggests that companies able to integrate primary and secondary production, backed by transparent sustainability credentials, will gain a competitive edge as regulations tighten and customer expectations rise.

One integrated view into 2026

Taken together, the global aluminium industry’s outlook for 2026 is defined by integration across the value chain, across end-use sectors, and across sustainability and profitability goals. Strong structural demand, constrained supply growth, supportive price fundamentals, and a decisive shift toward low-carbon and recycled aluminium form a compelling narrative. From bauxite to recycling, aluminium is not just growing, it is evolving. And for industry stakeholders, investors, and policymakers alike, a holistic, data-driven view of this evolution will be essential to unlocking the opportunities of the next phase of growth.