As the world leans heavily into the era of sustainability, electrification, and energy transition, aluminium has emerged as a silent enabler of global change. The Global Aluminium Industry Outlook 2025, an industry-focused market research report, presents a compelling and comprehensive roadmap of the sector’s transformative journey that merges economic opportunity with environmental accountability. With data-driven insights and expert predictions, the report is a clarion call for policymakers, investors, and industry leaders to prepare for what lies ahead.

A resilient industry navigating volatility

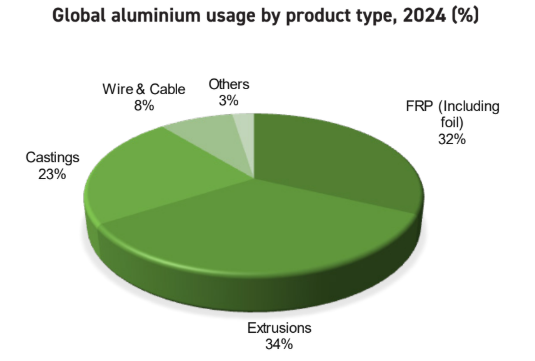

Despite a backdrop of global uncertainties—ranging from geopolitical tensions to inflationary pressures and supply chain upheavals—the aluminium industry has shown remarkable resilience. The report forecasts that global aluminium consumption will rise from 100.8 million tonnes in 2024 to 104.2 million tonnes in 2025, driven by its application across automotive, packaging, construction, and the renewable energy sectors.

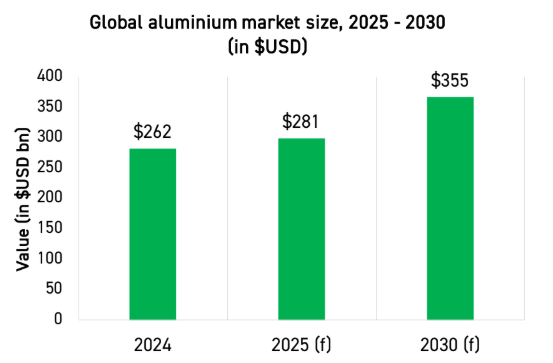

The global market size is projected to reach $355 billion by 2030, with a CAGR of 4.8%, signalling strong demand led by vehicle lightweighting, urban infrastructure expansion, and increased usage in energy-efficient applications. All the sectors related to the energy transition will grow strongly and will be a key demand driver for aluminium.

Potential drivers

Economic growth: Global economic expansion, particularly in emerging markets, is a major driver of aluminium demand. As economies grow, there is increased demand for infrastructure, construction, and consumer goods, all of which rely heavily on aluminium.

Transportation: The automotive and aerospace industries are significant consumers of aluminium due to its lightweight properties. The ongoing shift towards electric vehicles and fuel-efficient aircraft is likely to boost demand for aluminium further.

Renewable energy: The growing adoption of renewable energy sources, such as solar and wind power, requires substantial amounts of aluminium for components like solar panels and wind turbine blades. This trend is expected to continue driving aluminium consumption.

Packaging: Aluminium’s recyclability and lightweight nature make it an attractive material for packaging applications, particularly in the beverage and food industries. This sector is likely to contribute to the overall growth in aluminium demand.

Source: IAI, AL Circle Research estimates

Electric vehicles: Aluminium’s accelerating frontier

The automotive industry stands out as the most transformative driver among all end-use sectors. The transition to electric vehicles (EVs) has created a massive opportunity for aluminium, valued for its lightweight and corrosion-resistant properties. From battery housings to structural components, the material reduces weight and extends range—two key metrics for EV manufacturers.

Forecasts show global EV sales climbing from 17.1 million units in 2024 to over 65 million by 2035, potentially consuming nearly 10 million tonnes of aluminium annually. China, Europe, and the U.S. remain pivotal in this shift, propelled by ambitious government targets and consumer demand for cleaner mobility.

Renewable energy: Powering up aluminium’s potential

The aluminium industry is at the heart of the energy transition. Aluminium is indispensable in solar panel frames, wind turbine components, and power transmission systems. As the world moves to triple renewable energy capacity by 2030, the demand for aluminium—especially in wire rods—is expected to surge from 7.9 million tonnes in 2023 to 10.1 million tonnes by 2030.

This rise aligns with projections that renewables will supply 60–70% of global electricity by 2040, highlighting aluminium’s vital role in this energy evolution.

Supply dynamics: China leads, but the world watches

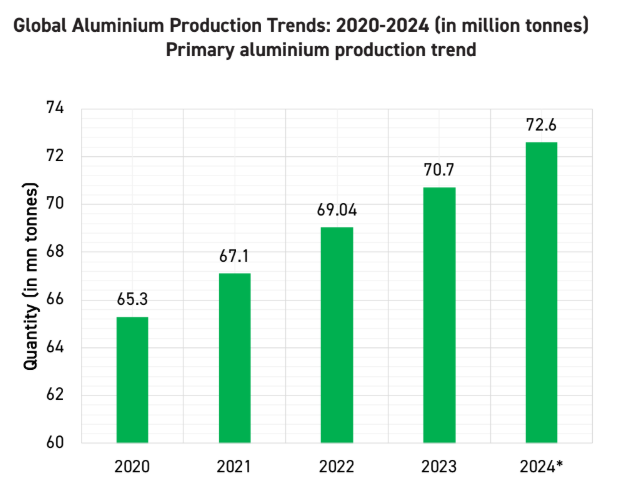

Primary aluminium production is projected to reach 74.5 million tonnes by 2025, up from 72.6 million tonnes in 2024. China remains the undisputed leader, contributing nearly 60% of global output, but faces production ceilings due to regulatory controls and environmental constraints.

Other regions, like India, the GCC, and Southeast Asia, are ramping up capacity to reduce global dependency on Chinese exports. However, Europe faces tighter supply due to stricter environmental norms, the looming threat of sanctions on Russian aluminium, and US tariffs on aluminium imports.

A sustainable future hinges on recycling

With 75% of all aluminium ever produced still in use, recycling is both an environmental and economic imperative. Recycled aluminium uses 95% less energy than primary production, making it a cornerstone of sustainability.

Europe leading the recycling efficiency rate, and more companies are embracing closed-loop systems to reuse manufacturing scrap. The report also highlights new investments in dross recycling, greenfield scrap facilities, and innovations to recover post-consumer scrap efficiently.

Aluminium prices: A return to stability amid recovery

Aluminium prices have been volatile, spiking to $2,704/tonne in 2022 amid post-pandemic recovery and then moderating to $2,419 in 2024. However, the present LME aluminium average price remains low at $2371 (April 1 – April 23, 2025). For 2025, prices are forecasted to remain higher than the present, buoyed by stable demand from clean energy, construction, and premium automotive segments.

This modest price optimism also factors in lower borrowing costs, easing inflation, and Chinese stimulus measures aimed at reigniting domestic demand.

Decarbonisation: The industry’s moral imperative

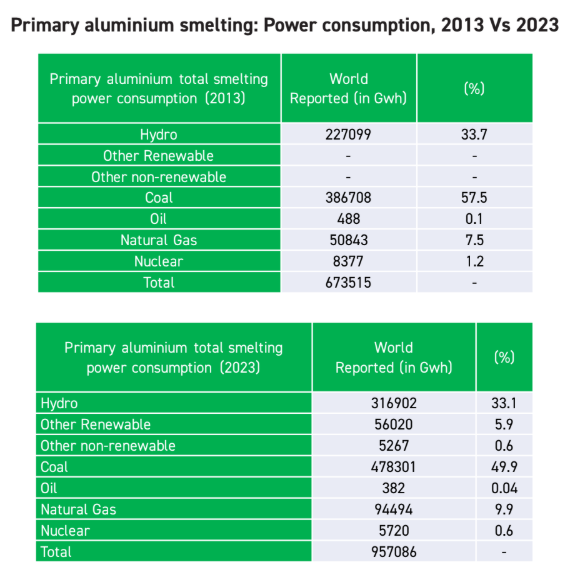

While aluminium is green by nature, its production is carbon-intensive. Aluminium production is energy-intensive, especially during the smelting process. In 2022, global primary aluminium production consumed approximately 13.2 MWh per tonne of aluminium and 2.8 GJ per tonne of anode. Additionally, alumina refining consumes an average of 10.2 GJ per tonne of alumina, or 20.4 GJ per tonne of primary aluminium, as 1.92 to 2 tonnes of alumina are required to produce one tonne of primary aluminium.

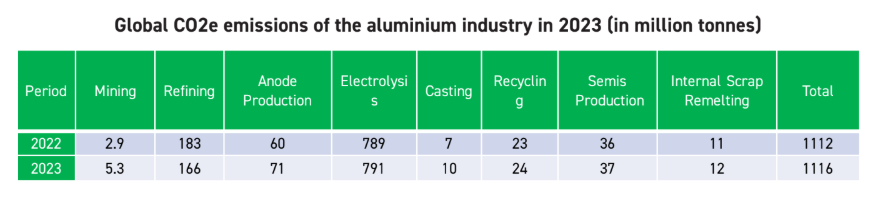

The traditional Hall-Héroult process, which extracts aluminium from alumina, is highly reliant on electricity, consuming around 14.1 MWh globally. The majority of emissions (71%) in the aluminium industry globally are from the electrolysis step, out of which, 78% are from indirect emissions (International Aluminium, 2023e).

Emission breakdown in aluminium production

The electrolysis process releases carbon dioxide as a byproduct. The global aluminium industry is actively and diligently seeking methods to minimise or eliminate these emissions and those from upstream processes. At the same time, it aims to maintain cost-effectiveness and operational efficiency. The image below illustrates the total emissions from the global aluminium industry.

Source: IAI

Aluminium sector today

The aluminium sector is a global industry that plays a crucial role in various aspects of modern life, such as the beverage and packaging industry, car manufacturing, household appliances, and aviation. It encompasses a range of activities, from mining and refining raw materials to producing finished aluminium. Sustainability has become central in global politics and industry (United Nations, 2023a).

Source: IAI

As environmental concerns and the need to reduce carbon emissions have gained prominence, the industry has been actively working to minimise its ecological footprint. This includes reducing energy consumption, adopting cleaner production methods, and increasing the recycling of aluminium products.

To address this, companies are racing towards low-carbon solutions:

- Alcoa’s EcoLum and Vedanta’s Restora offer aluminium with dramatically lower carbon footprints.

- Rio Tinto and Alcoa’s ELYSIS project is pioneering inert anode technology, which emits oxygen instead of CO₂.

- Hydro’s CIRCAL and Emirates Global Aluminium’s CelestiAL are using hydropower and solar to decarbonise their smelters.

- The industry is also exploring hydrogen fuel, carbon capture, and mechanical vapour recompression to green the entire production chain.

Macro trends and economic influences

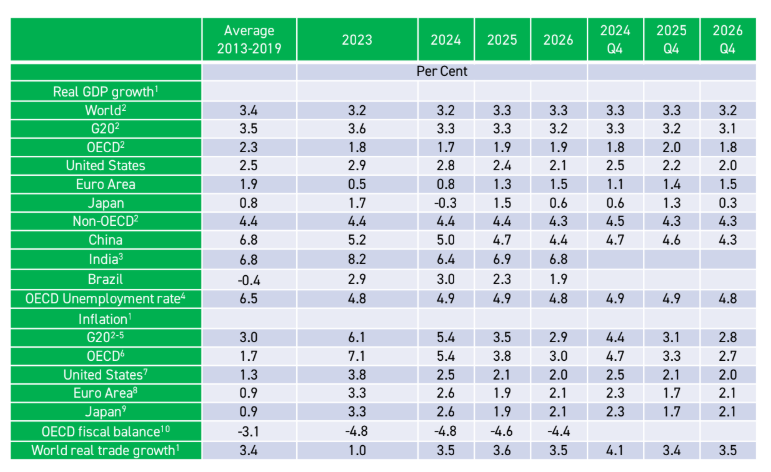

The World Economic Outlook for 2025 underpins much of the aluminium industry’s trajectory. With global GDP projected to grow by 3.3%, inflation easing, and interest rates stabilising, the economic environment is becoming more supportive of industrial growth.

Source: OECD Economic Outlook 116 Database (December 2024)

However, downside risks remain—from rising oil prices to trade restrictions and geopolitical flare-ups. These could impact raw material prices and introduce volatility in both supply and demand across regions.

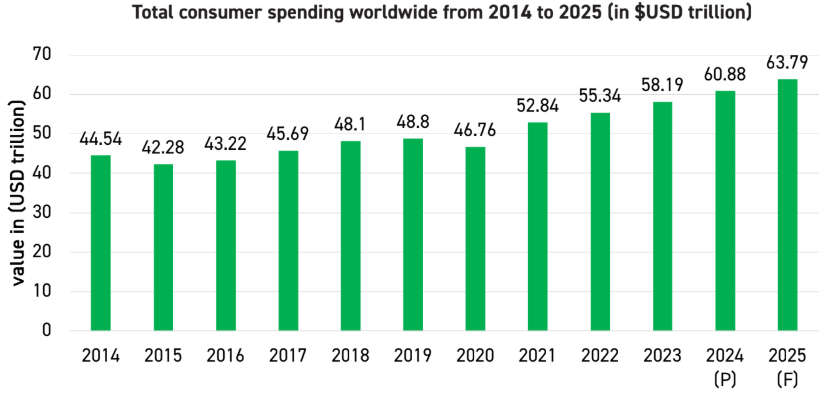

Source: Statista

Top trends to watch in 2025

- Deficit re-emergence: The global primary aluminium market is expected to slip into a supply deficit, driven by slower capacity additions and steady demand.

- Surplus anticipated: Alumina prices are expected to stabilise in 2025 after reaching a record-breaking high in 2024, and a surplus is also anticipated.

- EV boom: BEVs and hybrid vehicles will significantly boost aluminium use in powertrain and chassis components.

- Recycled content mandates: Governments are likely to legislate higher recycled content in consumer products, spurring circular economy initiatives.

- Premium market bifurcation: Low-carbon aluminium could command a significant premium in developed markets.

- Tech and traceability: The rise of blockchain and Industry 4.0 will enhance supply chain visibility and efficiency.

Conclusion: A critical metal for a sustainable tomorrow

As the global economy transitions to net-zero, aluminium stands at a pivotal intersection of opportunity and responsibility. The Global Aluminium Industry Outlook 2025 is more than a forecast—it is a blueprint for how the industry must evolve, invest, and innovate.

Source: Various industry publications, Hindalco Industries, primary interviews with industry experts, AL Circle Research estimate

From electrifying transport to decarbonising power and reducing packaging waste, aluminium will remain a key enabler of global sustainability goals. But for it to truly be the “metal of the future,” stakeholders must align on climate action, circularity, and collaborative innovation.

The future is not just about tonnes produced or dollars earned—but about tonnes saved, carbon avoided, and value created across generations.

Stay ahead of the curve with our comprehensive report, “Global Aluminium Industry Outlook 2025”. This definitive resource offers an extensive analysis across the entire aluminium value chain — from bauxite mining and alumina refining to primary aluminium production, downstream processing, and key end-user sectors.

The report also delves into the growing importance of recycled/ secondary aluminium, as well as the rising demand for High Purity Aluminium (HPA). It provides detailed regional analyses, price trends, and global demand and consumption forecasts, helping you make informed strategic decisions for 2025 and beyond.

Don’t miss the opportunity to stay informed about market dynamics, emerging trends, and future growth opportunities in the global aluminium industry.

Subscribe to “Global Aluminium Industry Outlook 2025” and equip yourself with the intelligence you need to lead.