The Turkish Aluminium Industrialists Association (TALSAD) was established on March 15, 1971, by leading Turkish aluminium industrialists to help and guide the growth of the national aluminium industry. TALSAD now represents 80 aluminium manufacturing and processing member companies as one of the oldest industry organisations in Turkey and confidently promotes the Turkish aluminium industry to the global markets. TALSAD, in order to promote the growth of the aluminium industry and guide sustainability initiatives, engages in training activities, fairs and events, symposiums and projects. These include ALUEXPO, one of the largest international aluminium fairs, and the International Aluminium Symposium held every two years in Istanbul.

TALSAD, in the 53rd year of its establishment, is facing a new challenge for the industry: align and lead the Turkish Aluminium Industry towards global decarbonisation initiatives, including EU Green Deal Initiatives. Europe being the largest partner of Turkey’s aluminium industry. One of its important initiatives, the Carbon Border Adjustment Mechanism (CBAM), is one of the pilot sectors selected for this carbon tariff. Anticipating the implications of the CBAM and the EU Green Deal, TALSAD proactively launched a project to help Turkish aluminium producers successfully adopt this new target of decarbonisation. The general aim of the project was to provide guidance, technical support and certification services on a business basis in the scope of the EU Green Deal. This initiative accelerated and enhanced the industry’s awareness of the evolving sustainability framework, the EU Green Deal, and CBAM even before the Commission’s proposal for the tariff was officially presented.

Under the coordination of TALSAD, in partnership with İDDMİB and ALUTEAM within the scope of Istanbul Development Agency’s Innovative Istanbul Financial Support Program for the Year 2021, the project named “Sustainability and Certification Centre for the Compliance of the Istanbul Aluminium Industry with the EU Green Deal Policies” was successfully completed in 2023.

With the goal of fulfilling the future demands in mind, TALSAD aims to create a structure that will help and guide companies in their decarbonisation path, by forming a Sustainability Certification Centre with its own financial cycle, as a part of international accreditation systems and will keep working towards sustainable growth and development of the Turkish aluminium industry.

Turkish aluminium industry: Strengthening economic ties and market presence

The Turkish aluminium industry encompasses organisations that manufacture goods by processing both domestically produced and imported ingots. These processes include casting, forming, rolling, drawing, and forging. Additionally, the sector processes scrap aluminium and ingots into final products by alloying them through various methods. Although the Turkish aluminium industry relies on foreign sources for approximately 95% of its raw material (primary aluminium) needs, it has made significant strides in producing finished and semi-finished products. As a result, it has become a key production hub within the European and Eurasian regions.

Turkey’s exports of finished and semi-finished aluminium products extend to a wide range of countries globally, encompassing nearly all nations. The top five export destinations are developed economies, including Germany, USA, Italy, Poland, and Greece. An analysis of the export distribution over the past decade reveals that the Turkish aluminium industry is progressively expanding its reach to a broader geographic area. Notably, 15% of Turkey’s aluminium product exports by quantity (tons) and 16.4% by value (USD) were directed to Germany. In 2023, the Turkish aluminium industry faced challenges marked by contractions in both exports and local consumption. This downturn reflects a reduction in Turkey’s export capacity and is linked to market contractions in our target countries. From January to December 2023, exports declined by 14.1% compared to the same period in 2022, amounting to 1.19 million tons, and export revenue saw a significant decrease of 20.7%, resulting in $5.3 billion.

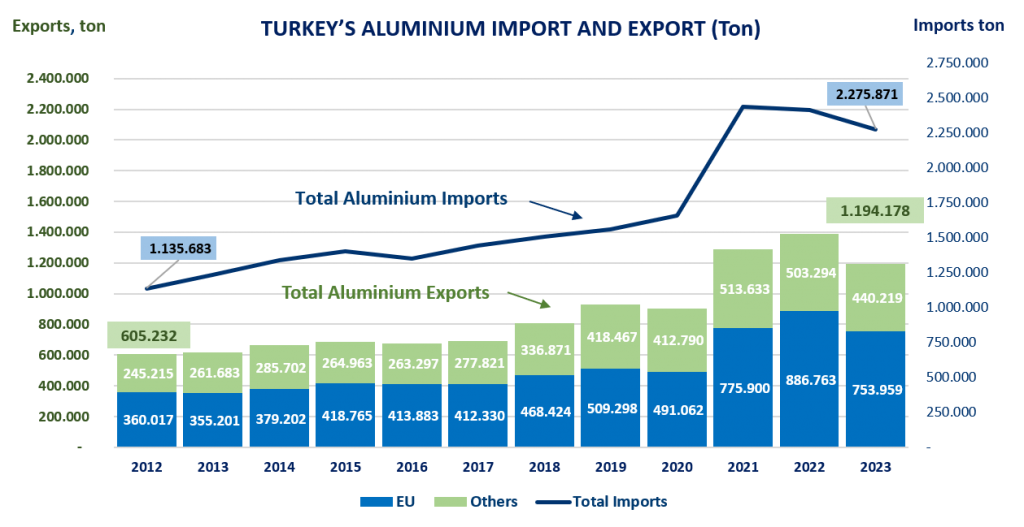

Turkey is a significant importer of aluminium raw materials on a global scale. Turkey stands as the world’s fifth-largest importer of aluminium, hosting the most significant aluminium industry in its region. With Europe and the USA being its largest markets, meeting the demands of these regions is of paramount importance. In 2023, Turkey’s total aluminium imports reached 2.275.871 tons, with primary aluminium making up 74.3% of this total. The value of these imports amounted to $6.3 billion in 2023, reflecting a decrease in USA Dollar terms compared to previous years, corresponding to a relative decline in London Metal Exchange (LME) prices.

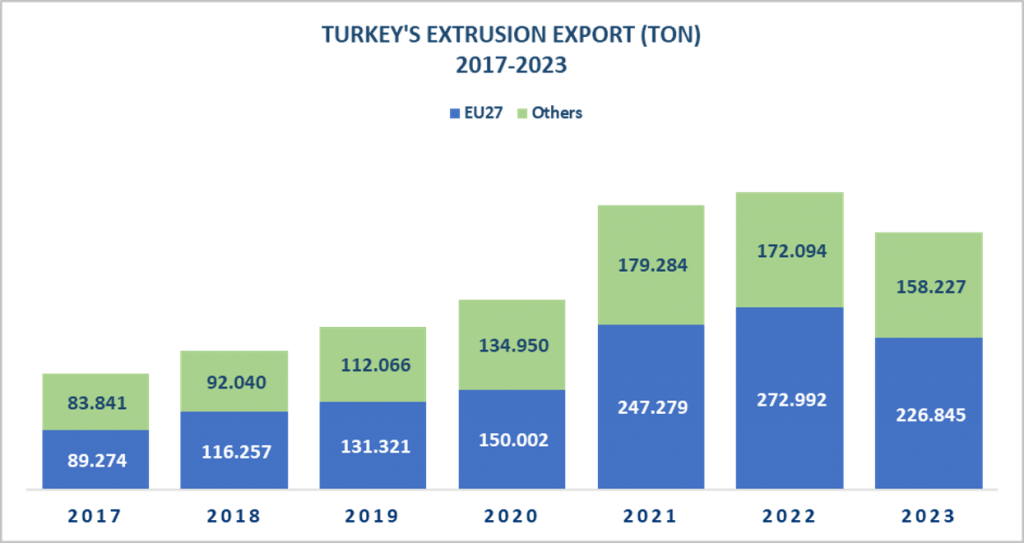

Throughout the year, Turkey maintained its status as Europe’s second most significant supplier of aluminium-finished and semi-finished products. This noteworthy achievement played a role in shaping the European Union’s decision on anti-dumping measures against China for aluminium extrusion products. The sector’s success stems from its established presence, with continuous growth over fifty years, bolstering production capacity and talent. These developments marked 2023 as a year of re-establishing market share and equilibration of export markets. The contractions observed in exports and production in 2023 are expected to continue in 2024 due to Turkey’s general economic instabilities, high inflation, and import-export dependencies. In 2023, exports of extrusion products, which constitute 32% of the total exports across all product groups, decreased by 13.5% compared to the previous year, amounting to 385,072 tonnes.

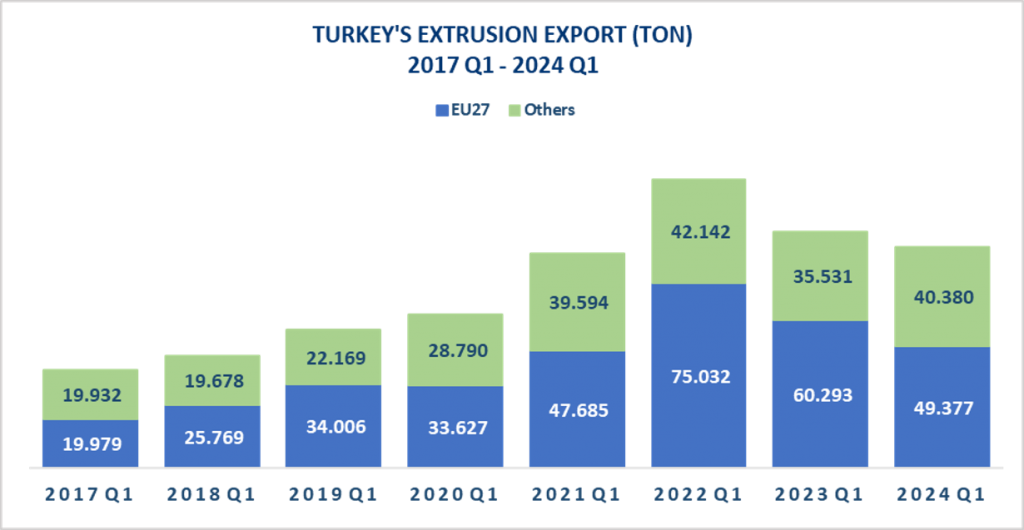

This downward trend continued into the first quarter of 2024, with exports totalling 89.757 tonnes, representing a 6.3% decrease compared to the first quarter of 2023. As of March 2024, Turkey’s extrusion exports have reached 144 countries worldwide, with 57% of these exports directed to EU member states. Illustrated in the chart below, the robust growth from 2017 to 2022 has decelerated over the past two years due to market contractions and economic challenges.

Overall, the global demand for aluminium is expected to reach a 7% annual growth rate by 2050. Considering this big change in world aluminium demand and the rapid growth of the Turkish aluminium industry, it is inevitable that it will further consolidate its position as the most important industrial production and supply centre of the aluminium world.