It was encouraging to see that decarbonisation efforts across the global aluminium value chain by a number of companies paid off, as the latest available data on industry greenhouse gas (GHG) emissions and production for 2022 were released by the International Aluminium Institute (IAI) in late February 2024.

According to this data, industry-wide GHG emissions show a decline despite an increase in global aluminium production. Investments in three sector decarbonisation levers: electricity decarbonisation, direct emissions reductions, and increased recycling and resource efficiencies, as defined by the industry transition strategy, have yielded the first encouraging results.

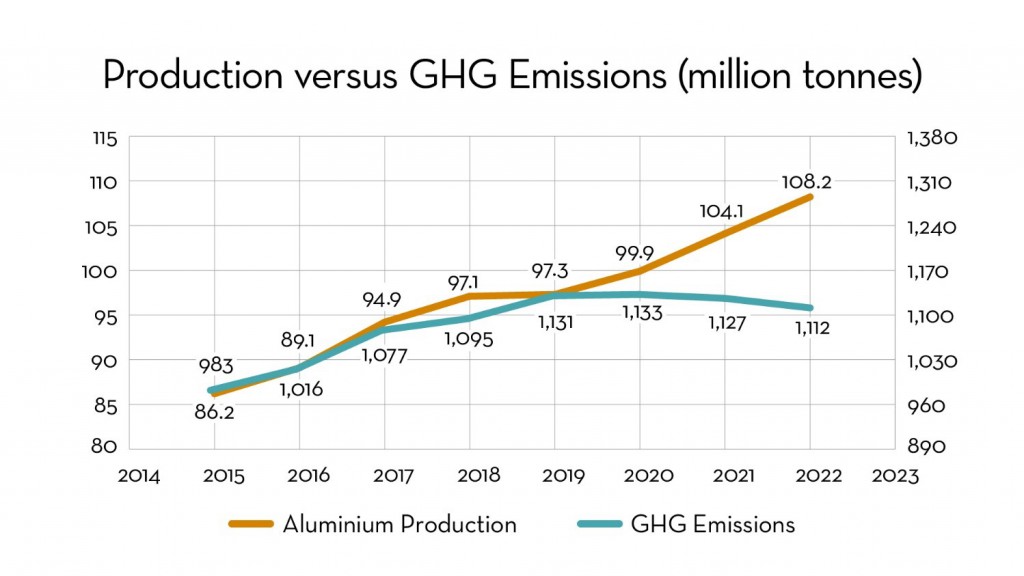

Global aluminium production in 2022 grew by 3.9% from 104.1 million tonnes to 108.2 million tonnes while at the same time the GHG emissions declined slightly from 1.13 gigatonnes CO2e to 1.11 gigatonnes CO2e.

This decoupling of GHG emissions and production led to the average quantity of emissions from the production of a tonne of primary aluminium in 2022 to decline by 4.4% from 15.8 tonnes CO2e per tonne to 15.1 tonnes CO2e per tonne.

The change is incremental but symbolically important as it delivers on industry strategy. The year 2022 was the first year that these intensity reductions offset production growth and offer proof that the industry is heading in the right direction. There is hope that if the industry continues to attract investment and implement low-carbon energy sources and GHG reduction technologies, 2021 could be the year that GHG emissions from the aluminium industry peaked.

From commitments to action

More profound change requires decisive and broad action by all industry players. Further investments across all three decarbonisation layers are needed, including in large upscaling of new carbon-free technologies. Demand initiatives such as the First Movers Coalition (FMC), which gathers some of the largest users of aluminium, harnesses the purchasing power of its members, big private buyers of low carbon primary aluminium, and directs it towards surfacing of supply as early as by 2030.

A strong demand signal sends a clear invitation to producers of low-carbon primary aluminium to further invest in production of necessary volumes. As the signal increases, with more buyers coming forward ready to commit to purchasing green primary aluminium that comes with a green premium, the more confident suppliers should be to invest in additional production capacities.

By strengthening the demand signal, the FMC tries to speed up these investment processes. Individual offtakes concluded by its sector members translate purchasing commitments into action and ultimately drive the reduction of industry emissions.

Since aluminium is a key enabler to reduction of emissions in other sectors such as automotive, transport, building & construction, and packaging, the call for faster decarbonisation of the industry is about to bring significant and broad social and environmental changes.

The main way to help the industry is by allowing key enablers and removing key impediments to a fast transition.