China’s primary aluminium production in August marginally grew month-on-month from the previous month’s high by 0.16 per cent, indicating a steady operational scenario. At the end of August, the domestic operating capacity was 43.49 million tonnes versus 43.42 million tonnes a month ago. China’s primary aluminium production volume stood at 3.689 million tonnes in August versus 3.683 million tonnes in July 2024. Annually, the August output recorded an increase of 18 per cent. From January to August 2024, China’s total primary aluminium production amounted to 28.545 million tonnes, up by 4.6 per cent year-on-year.

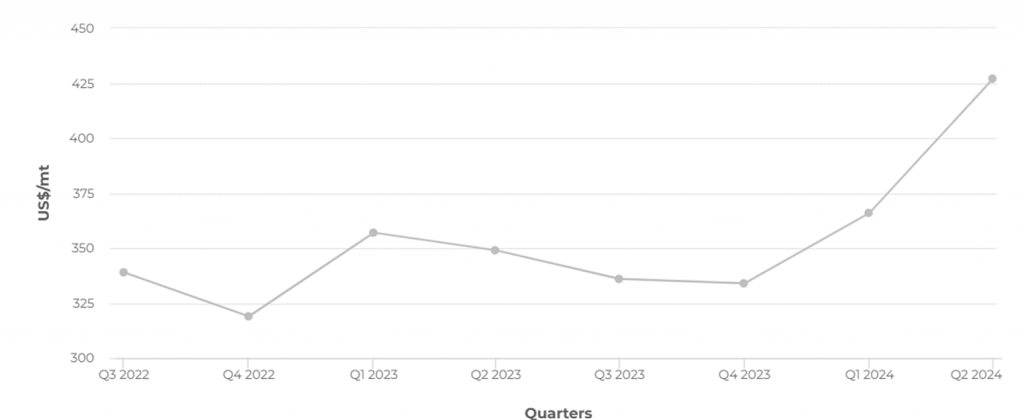

In August 2024, alumina prices averaged USD 497 per tonne, marking a 2.1 per cent increase compared to July. By 30 August, the commodity had reached USD 514 per tonne, reflecting a 7.4 per cent rise from 31 July.

Alumina price (US$/tonnes), 2022-24

Source: Focus Economics

Over the past month, the price surge was driven by rising demand from aluminium producers. Chinese output hit a new record high for the second consecutive month in July. Meanwhile, supply remained constrained due to recent production cuts at Alcoa and Rio Tinto’s alumina refineries in Australia. The Australian market, too, is reeling from high alumina prices.

The reason behind the price rise

The top alumina exporting nations have been facing supply chain issues and disruptions in production since Q2 of 2024. This has resulted in an alumina availability crunch.

China

Several events in China’s domestic market have impacted the supply chain, driving significant price movements. The explosion at Guinea’s oil depot in late 2023, as China is the biggest importer of bauxite from the West African nation, along with the shutdown of domestic bauxite mines in Henan and Shanxi, compounded by the closures and production cuts at alumina plants in Hebei and Shandong due to severe pollution, raised concerns about bauxite supply. This, in turn, led to a sharp rise in alumina prices in January. However, following the Spring Festival through the first half of April, alumina prices stabilised, with only a slight decline and a relatively modest overall price drop.

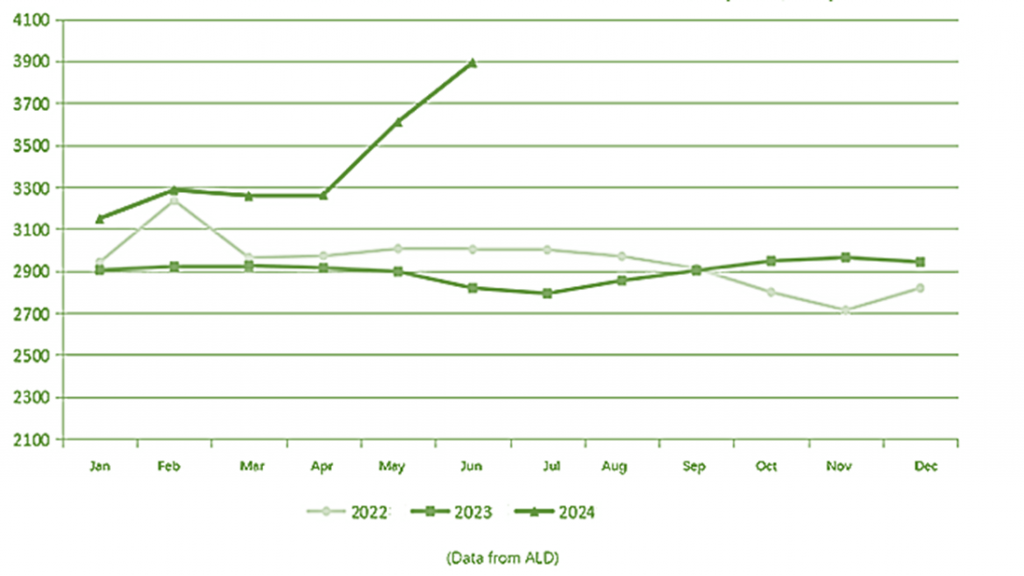

China domestic alumina price trend (RMB/tonne)

Note: 2024 up to June

From mid-April to May, domestic alumina prices experienced a rapid surge, driven by a broader rise in commodity prices, eventually reaching record highs. However, with the decline in futures prices by June, spot transactions saw a significant drop, and prices entered a stable period.

In the first half of the year, domestic alumina spot prices ranged from a high of RMB 3,917 per tonne to a low of RMB 3,156 per tonne, with an average of RMB 3,504 per tonne—an increase of 21.0 per cent year over year, indicating promising growth in the market. Apart from these incidents, Indonesia’s bauxite ban resulted in a limited disruption in China’s alumina production.

The trend in the international market mirrored that of the domestic market, although the rate of price increase was more moderate.

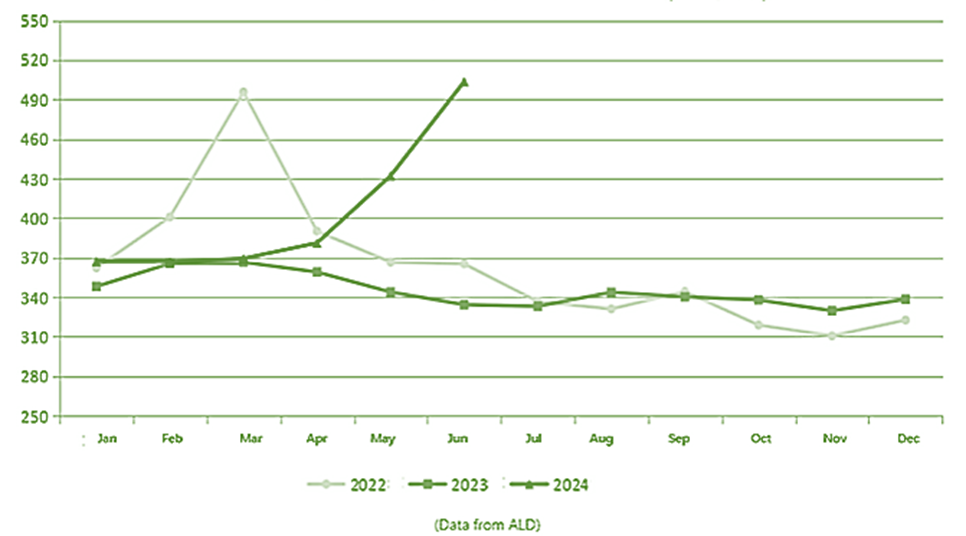

Australia

In March 2024, Rio Tinto’s Yarwun and Queensland alumina plants in Australia were impacted by a fire on a natural gas pipeline, reducing their operating capacity by approximately 1.2 million tonnes per year. Consequently, Rio Tinto declared force majeure for both plants in May. Additionally, in April, Alcoa shut down its Kwinana alumina plant in Australia, further reducing production capacity by around 2.2 million tonnes annually. These events have caused a significant decline in overseas alumina supply, driving prices upward.

In the year’s first half, the alumina international spot price (FOB) fluctuated between a high of USD 511 per tonne and a low of USD 354 per tonne, averaging USD 403 per tonne. This represents a year-on-year increase of 14.3 per cent.

International alumina price trend (USD/tonne)

Note: 2024 up to June

India

India’s Nalco alumina refinery faced a logistical issue which resulted in delayed shipments of alumina and exacerbated the alumina supply disruption.

Impact on the global aluminium industry

The rise in the prices of alumina has had a cascading effect on the entire global aluminium industry.

- Increased input costs

The rise in alumina prices is eating away the profits generated by aluminium smelters – especially those that don’t have their own alumina refinery. Alumina is the most critical raw material needed to produce aluminium. A rise in the prices of this raw material directly translates to increased production costs.

- Increase in aluminium prices

The increase in alumina prices has translated to an increase in the price of finished aluminium products as well. For example, in China, A00 aluminium ingot rose by RMB 180 per tonne. As of 13th September 2024, the LME Aluminium price grew by 5% versus the previous month.

- Potential advantage

The rise in alumina prices hasn’t entirely spelt doom across the industry. Rather, this price rise has translated to an increase in revenue. The Q2 financial result published by Alco reveals a 12 per cent increase in revenue – which has been attributed to the increase in alumina and aluminium prices. Norsk Hydro, too, reported a similar trend. Although its EBITDA was down from NOK7098 to NOK5839, the downward trend was somewhat offset by an increase in Alumina prices, which became a revenue driver for the company. China, too, has started ramping up bauxite imports to increase alumina production in order to take advantage of the increased price.

- Trouble for downstream sectors

Aluminium smelters reeling from high alumina costs have been trying to pass the increased cost of production to end users. This essentially means that downstream industries – the end consumers of aluminium have to shell out more. The automotive and aerospace – in particular – are susceptible to this rise in aluminium prices.

Words of caution from industry experts

Henry Van, a senior analyst at commodity trading group Trafigura, sounded cautiously optimistic about the situation. According to him, if alumina prices keep touching new highs, smelters would have no option but to reduce production. However, he is of the opinion that the upward trend won’t continue for more than a year. However, Concord Resources Ltd did not share this optimism. According to the metals trading house, alumina prices are more likely to remain high for a longer period than expected.

Supply and demand side

On the supply side, China’s alumina production capacity reached 104.35 million tonnes annually by the end of June 2024. However, supply was constrained by bauxite shortages, as well as safety and environmental regulations, leading to widespread production cuts. The operating rate of domestic alumina plants dropped to 76.2 per cent in January. Although production efforts increased due to a sharp rise in alumina prices, the recovery in capacity remained slow.

On the demand side, the domestic electrolytic aluminium industry maintained stable production throughout the first half of the year, with operating capacity and utilisation rates reaching record highs, driving up the demand for alumina. As a result, the domestic alumina market experienced a supply shortfall of 890,000 tonnes, a significant increase compared to the same period last year.

By the end of August, domestic bauxite supply has yet to recover, and shortages are expected to persist in the short term. Additionally, the rainy season in Guinea is beginning to impact imported bauxite, further tightening supply through September. As a result, bauxite prices are likely to remain elevated in the near term, driving up alumina production costs and providing strong support for alumina prices.