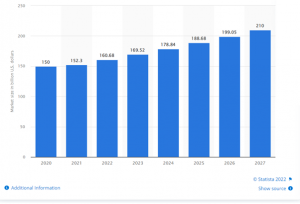

According to Statista, the global aluminium market will reach an estimated US$210 billion in 2027, rising at a CAGR of 5 per cent from US$150 billion in 2020. The transportation and construction industries will primarily facilitate this growth. Despite the promising numbers, the lurking global economic crisis, geopolitical conflicts, and energy crisis in the European Union may affect the aluminium industry.

A slump in the aluminium trade has been observed recently in many regions, and this is keeping experts up at night.

The growing popularity of the metal across different end-user sectors made the manufacturers hopeful that aluminium’s future was bright. However, several unprecedented factors are adversely affecting the industry, and no gainsaying the fact that the impacts can be seen in prime markets like Europe, America, and Asia.

European aluminium market and the economic crisis:

Europe is bouncing from one crisis to the other, and the struggle does not seem to end for them. Currently, it is riddled with the economic crisis as well as the energy crisis, and each of them is bleeding the aluminium industry. In 2021, European smelters were forced to cut down (or shut down) production as they struggled to keep up with the energy-intensive manufacturing processes.

However, the energy crisis is not the only reason why the European aluminium industry is suffering. The geopolitical conflict between Russia and Ukraine is also acting as a catalyst. Rusal, the largest aluminium producer in Russia had stopped production at its 1.75 million tonnes alumina capacity in Nikolaev, Ukraine, and suspended shipments. Although the company mentioned the cause as logistical issues, the reasons are evident. The fate of this refinery and Europe’s aluminium sector inevitably lies in the hands of geopolitical tension. It was also reported that the company’s shares plummeted.

The London Metal Exchange was also earlier considering banning new deliveries of Russian aluminium. But post consultation with some consumer associations, they have now reconsidered their decision and chosen not to sanction Russia. Rusal produces 6% of the global aluminium, and the US sanctions on Rusal in 2018 wreaked havoc in the supply chain.

Europe is under immense economic pressure as the energy crisis continues to rise and the economy continues to plummet. Other reasons Europe’s aluminium industry is suffering include undermining of the production and recycling capacity by supply chain disruptions, unfair trade practices, and high regulatory costs. Due to these reasons, the market lost 30% of its primary aluminium production capacity. By the end of 2022, Europe is expected to lose another 1.1 million tonnes of primary aluminium production capacity because the energy price inflation has affected Europe more than any other region.

1 million tonnes of total 4.5 million tonnes of Europe’s aluminium production capacity has been reduced since 2021, while another 500,000 tonnes is under threat, according to Citi analysts.

American aluminium market and the economic crisis:

The aluminium market in North America seems grim, and the delay in the buyer-seller mating season is making the manufacturers anxious. The aluminium shipping prices have dipped by 11% in the region, causing buyers to hold back purchases in hopes that the prices will fall further. The fear of inflation and supply chain bottlenecks are forcing buyers to rethink before ordering as they believe in overstocking the metal.

Furthermore, earlier in 2022, American buyers refrained from making new purchases as the geopolitical tension in Europe was likely to impact the supply chain, with inflation and recession being right around the corner. The USA’s Rusal sanctions of 2018 sent the world into a frenzy, impacting the supply chain. Again this time, the Russia-Ukraine tension is casting its shadow on the US aluminium.

The automobile industry makes up 31% of the United States’ aluminium needs. However, in March-April of 2022, a demand slowdown was recorded as the shipping charges plummeted, indicating a decrease in quoting activities. This could be linked to the shortage of semiconductors that the industry was facing in early 2022. Some experts are warning buyers of the surging interest rates, where most customers are accustomed to almost no interest rates on funds used to finance their aluminium purchases.

Besides the supply chain, the rising supply costs are also troubling the manufacturers, and the second largest domestic producer of aluminium in the US, Century Aluminium Co., declared in June 2022 that it would close production in one of its plants and lay off 600 employees. Therefore, the economic crisis is deeply cutting the aluminium sector in America. Additionally, the largest producer of aluminium in the US, Alcoa Corp, warned its investors of low earnings in the third quarter due to all these factors.

China and the aluminium market crisis:

It is no secret that China plays an important role in the global aluminium supply chain. However, it seems like they could not shield themselves from the ongoing crisis. The outbreak of a new Covid-19 strain in China has left the aluminium industry unsettled. Due to the first wave of the Covid-19 pandemic in 2020, China’s primary aluminium production was estimated to fall to 3.105 million tonnes in May and further to 3.005 million tonnes in June, as reported by SMM News.

From 2005 until the next 15 years, China accounted for the entire world’s incremental aluminium production. In fact, in 2021, it had a market share of 58% in total production of 67 million tonnes. One of the reasons leading to this large market share is a cheap power source. Extracting aluminium from bauxite is an energy-intensive process, and manufacturers preferred the coal-fired stations of China, which were light on the pockets and heavy on pollution.

However, due to the frequent power outages, China forced smelters to shut down production and conserve electricity. This approach was similar to the European smelters troubled by the energy crisis. However, China’s power rationing is not similar to Europe’s energy crisis. But China’s attempt to lower carbon dioxide emissions is hurting the supply chain. The demand for aluminium was on the rise in 2021, especially created by automotive giants like Ford and Tesla. A recent report highlighted that due to reduced production, the aluminium market slipped into a deficit of more than one million, and the trend was to be seen in 2022. Additionally, the deficit also impacted the stocks, with current primary aluminium inventories hovering around 518,000 tonnes as of November 24. Similarly, global inventories on the London Metal Exchange are down from 5.5 million tonnes in 2014 to a little more than 500,000 tonnes at the end of November 2022. Additionally, a consultant group, CRU, predicted that the estimated existing stock could only cover up to 36 days by the end of 2022.

Final words:

The cost of energy is likely to rise in the future as environmental policies, resulting in the surge of aluminium prices as an effect of ‘greenflation.’ The aluminium scene in Europe does not seem to improve in the near future, and only time will tell how the market revives from these financial blows.

However, it is not all downtrend for the sector. Although the construction and automotive industry in the US is not promising at the moment, experts believe that solidifying the demand in the packaging and beverage can industry and the aerospace industry will keep the manufacturers optimistic.

Nevertheless, China’s aluminium situation has to improve to maintain the global inventory. Therefore, either existing plants have to open up, or new smelters need to be set up in other parts of Asia. In the case of China, the economic crisis is not the only hindrance to the aluminium sector; environmental issues are also its foe.