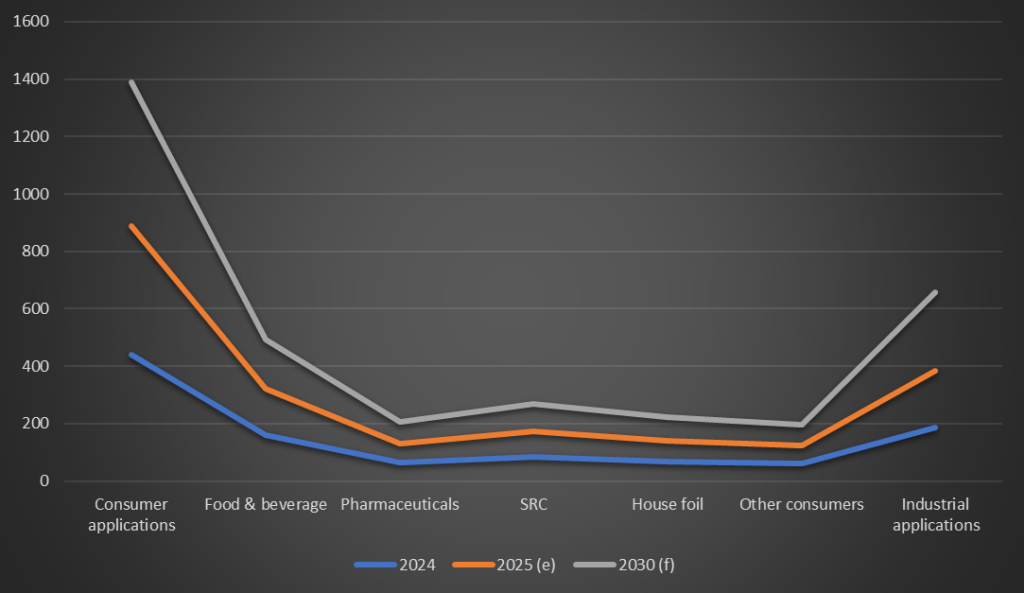

The aluminium foil market in North America is witnessing steady growth, underpinned by evolving consumer preferences, technological innovation, and expanding applications across industries. In 2024, the region’s total aluminium foil demand stood at over 600,000 tonnes, accounting for 8-10 per cent of global consumption. According to ongoing market data analysis, this demand is projected to cross 700,000 tonnes by 2030, signalling a moderate yet consistent upward trend in both consumer and industrial applications.

North America: Aluminium foil consumption and forecast by end-use sectors, 2024-2030 (000 tonnes)

Source: AL Circle Research

North America (Excluding – Mexico)

Industry landscape and market overview

The United States and Canada form the backbone of the North American aluminium foil market. Annual consumption in the United States typically ranges between 550,000 – 600,000 tonnes, with over 500,000 tonnes recorded in 2024, while Canada accounted for over 50,000 tonnes. Despite market maturity, the sector continues to evolve, driven by sustainable packaging innovations, increased demand for flexible packaging, and the growth of end-user industries such as food, beverage, healthcare and electronics.

Through extensive industry trend research, it is evident that aluminium foil remains indispensable due to its versatility, recyclability, and superior barrier properties. It safeguards product integrity against moisture, light, and contaminants, making it a preferred material in both consumer and industrial packaging applications.

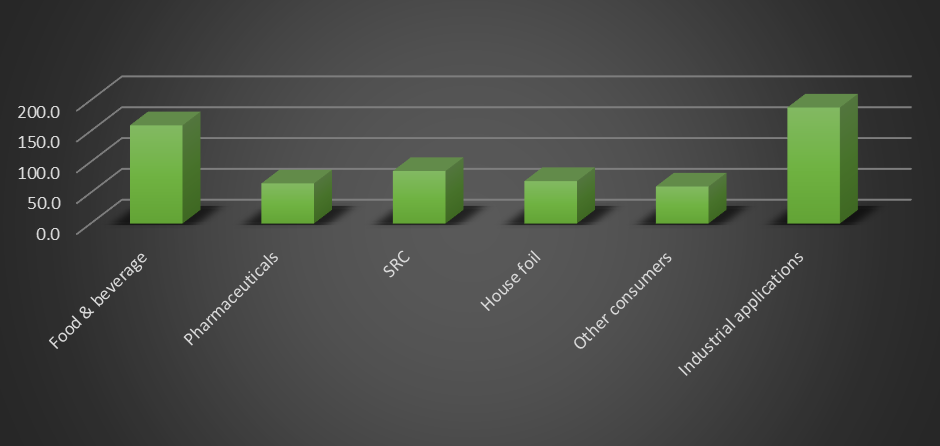

North America aluminium foil usage by end-use, 2024 (000 tonnes)

Source: AL Circle Research

North America (Excluding – Mexico)

Consumer packaging: The growth engine

In 2024, consumer packaging applications consumed about 439,000 tonnes of aluminium foil across North America. This segment continues to dominate due to the proliferation of flexible packaging formats and rising demand for ready-to-eat meals and single-serve products.

The food and beverage industry represents the largest consumer of aluminium foil, accounting for 25.4% of total usage. Usage is expected to increase from 160,000 tonnes in 2024 and reach or cross 170,000 tonnes by 2030, underscoring stable demand growth. Flexible packaging lightweight, cost-efficient and sustainable has gained a significant competitive edge, reshaping market share dynamics across the packaging ecosystem.

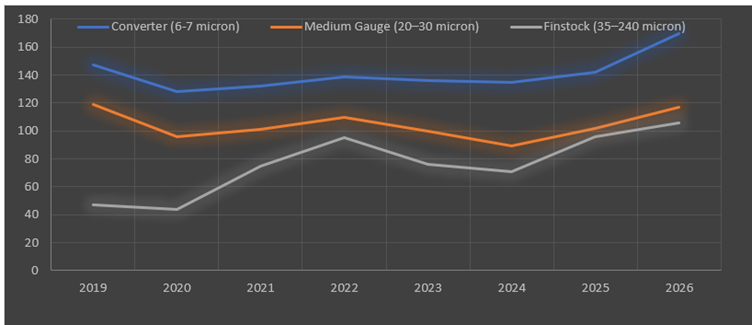

The US flexible packaging market reached US$42 billion in 2024, representing about 20% of the nation’s total packaging sector. With more than 450–500 converters operating nationwide, the top 25 companies generate nearly 75% of the sector’s revenue, reflecting high consolidation within the industry.

U.S. conversion price for Finstock

Note: Annual data: cent/lb over MWTP, delivered; excluding surcharges

Aluminium foil is now integral to packaging a diverse array of products from food, beverages and confectionery to pharmaceuticals, supplements, and medical devices. It even plays a crucial role in producing Meals Ready-to-Eat (MREs) for the US military and in serving healthcare, education and retail foodservice sectors.

Semi-rigid containers: A key market segment

Semi-rigid aluminium containers are increasingly favoured for their lightweight, durable, and versatile nature. These containers are used for freezing, storing, transporting, and cooking various foods. In 2024, North America consumed around 85,000 tonnes of aluminium foil for container manufacturing a figure expected to reach nearby 100,000 tonnes by 2030.

Prominent suppliers in this segment include Reynolds, AMCOR, Pactiv Evergreen, Handi-Foil, Durable Packaging International, Penny Plate, Pactogo, Trinidad Benham, D&W Fine Pack and Revere Packaging. Their collective innovation and supply network continue to shape the market share trends within the regional packaging landscape.

Industrial applications: Expanding technical uses

Beyond packaging, industrial applications account for nearly 29.9% of North America’s total aluminium foil usage, equivalent to about 188,000 tonnes in 2024. Aluminium foil plays a vital role in producing fin stock for HVAC systems, thermal insulation materials, electrical cables, battery foils, and electronic components.

As industries transition toward electrification and renewable technologies, demand for aluminium foil in energy storage and electronic mobility applications is expected to surge, contributing to new growth opportunities identified through ongoing market intelligence analysis.

Key insights and outlook

Stable yet steady growth is forecast through 2030, driven by packaging modernization and energy-efficient applications.

Sustainability and circularity will dominate industry landscape analysis , with recycling initiatives and lightweight product design becoming competitive differentiators.

The shift toward flexible and functional packaging underscores strong market share trends in food, pharmaceutical, and personal care sectors.

Continuous industry trend research highlights expanding use in battery and EV technologies, reflecting aluminium foil’s strategic role in the decarbonisation agenda.

Conclusion

The North American aluminium foil market continues to evolve, shaped by sustainability goals, innovation in packaging, and emerging industrial technologies. Through ongoing market data analysis and market intelligence insights, it’s clear that aluminium foil will remain an essential material across multiple value chains, balancing efficiency, performance, and environmental responsibility.

As the region moves toward 2030, companies that align with eco-friendly production, digital transformation, and circular economy principles will be best positioned to lead this dynamic and evolving market.