Imagine two worlds shaping the same metal.

In one world, aluminium is born from the earth. Bauxite mines, alumina refineries, smelters humming with megawatts of power, here, geography decides destiny. Countries rich in natural resources and energy infrastructure dominate. This is the world of primary aluminium, deeply resource-driven, capital-intensive and strategically tied to power costs and raw material access.

In the other world, aluminium is reborn.

Used beverage cans, automotive scrap, demolished buildings, old window frames, collected, sorted, melted and cast again. Here, the driving force is not the mine, but the market. Consumer behaviour, automotive production cycles, sustainability mandates and circular economy policies all influence volumes. This is secondary aluminium, demand-driven, agile and increasingly strategic.

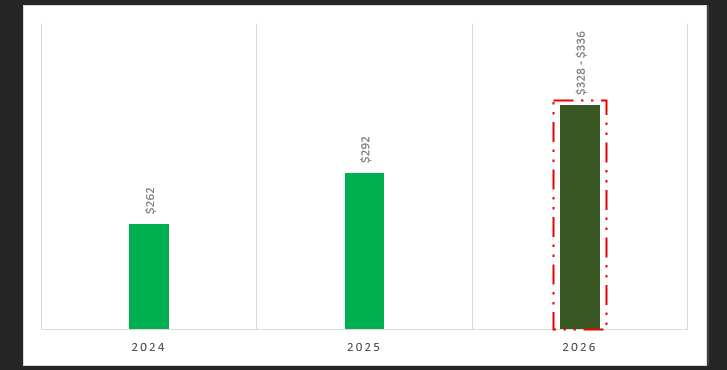

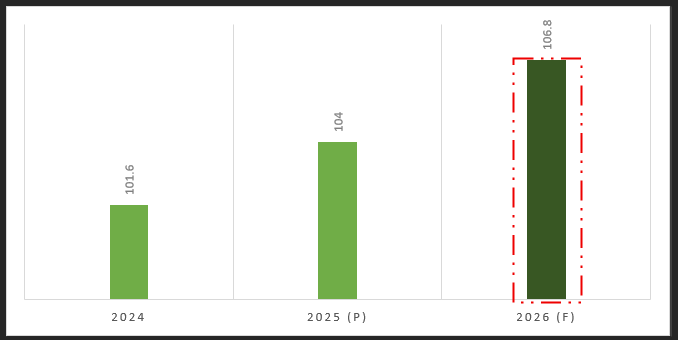

Global aluminium market size, 2024-2026(f) (in USD$ Billion)

Source: AL Circle Research

And today’s aluminium industry lives in the tension and opportunity between these two worlds.

The resource-driven engine

Primary aluminium production depends fundamentally on three pillars: bauxite availability, alumina refining capacity and low-cost power. Nations such as Australia, Guinea and China have shaped global supply not just because of demand, but because they command the upstream value chain.

A market intelligence analysis of primary aluminium often begins with:

- Energy price trends

- Captive power strategies

- Carbon cost exposure

- Logistics and port infrastructure

When power prices spike, margins compress. When bauxite supply tightens, global prices react. The supply side dictates the rhythm.

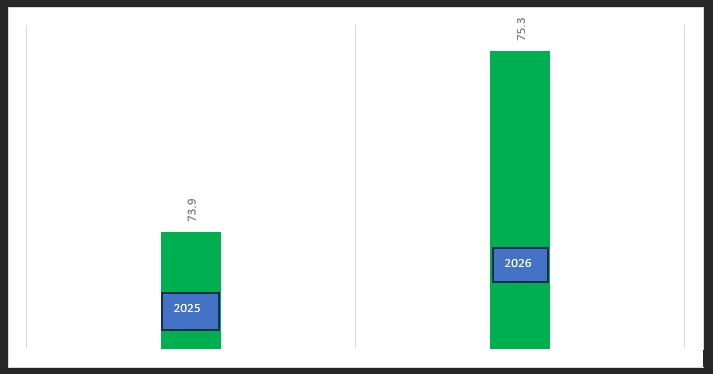

Global primary aluminium production & forecast, 2025-2026 (f) (in million tonnes)

Source: AL Circle Research

In this segment, global market trends are often influenced by geopolitical and macroeconomic factors. Sanctions, energy transitions, mining regulations and ESG policies reshape supply curves overnight.

The demand-driven pulse

Secondary aluminium tells a different story.

It responds to electric vehicle adoption. It tracks beverage consumption. It follows construction cycles. It thrives on sustainability commitments by OEMs.

If a major automotive hub accelerates EV production, secondary alloy demand surges. If packaging regulations favour recyclability, scrap flows increase. This is where a market segmentation study becomes powerful, breaking demand by end-use sector: transportation, packaging, construction and consumer durables.

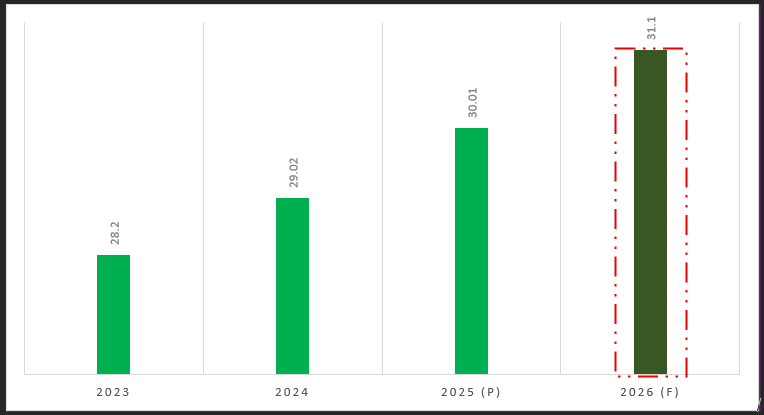

Global secondary aluminium consumption, 2023 – 2026 (million tonnes)

Source: AL Circle Research

Unlike primary metal, secondary production is less about mines and more about material loops.

In markets such as India and the United States, rising urbanisation and regulatory focus on recycling are reshaping supply-demand dynamics. Scrap availability, collection efficiency, and import-export policies become central to strategic planning.

Secondary aluminium moves with consumer economies. It mirrors industrial output.

Where strategy meets reality

The most sophisticated players today don’t view primary and secondary as competing models. They see them as complementary levers.

Primary ensures volume security. Secondary ensures margin flexibility and sustainability positioning.

From an industry-wide perspective, the future will not be defined by one or the other but by how intelligently companies balance both within their portfolio strategy.

For decision-makers, the key is clarity:

- Resource-driven segments require supply-side risk assessment.

- Demand-driven segments require granular consumption tracking.

- Integrated strategies require cross-cycle planning.

The aluminium industry is no longer just about producing metal. It is about understanding flows of energy, scrap, regulation and demand.

Global aluminium consumption trend & forecast, 2024 – 2026 (f) (in million tonnes)

Source: AL Circle Research

And in that understanding lies competitive advantage. Because in this story, aluminium is not just mined or melted. It is measured, analysed, segmented and strategically positioned.

Great insights on the dual dynamics shaping the aluminium market. It’s interesting to see how resource-driven primary aluminium remains heavily dependent on bauxite and energy costs, while demand-led secondary aluminium is increasingly influenced by circular economy trends and recycling innovations. The shift toward more sustainable practices in both sectors will likely define the industry’s trajectory in the coming years.