The 10% tariffs on all imported aluminium imposed by Trump in March 2018 have generated ample interest in the North American aluminium sector, more so because Trump’s tariffs also included Canada and Mexico, Canada remaining the top aluminium supplier to the U.S. so far. While major part of the industry players opposed the tariffs, claiming that the tariffs will disrupt the North American aluminium supply chain, there were also a section who firmly believed that tariffs helped the resurrection of the primary aluminium sector in the U.S. It was the downstream players in the U.S. who had to bear the impact of aluminium tariffs. Most of the industry associations in North America lobbied against the tariffs and the proposed import quota on Canada and Mexico. Finally, the tariffs on Canada and Mexico have been lifted in May. An analysis of the production trends in primary aluminium in the U.S. and Canada in the first five months of 2019 will give a clearer picture of how the tariffs impacted the industry.

Aluminum Association surveys the primary aluminium industry in the U.S. and Canada by taking into account the production numbers of all major producers.

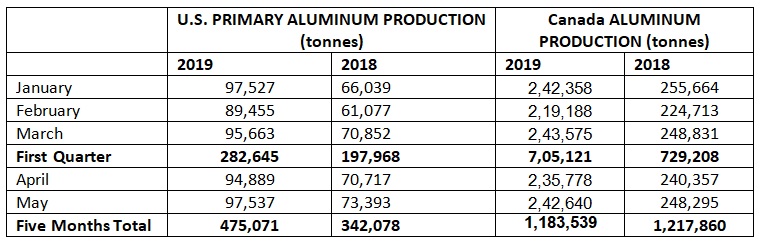

Based on Aluminum Association surveys, as shown in the table above, the U.S. registered the highest primary aluminium production in May at an estimated 97,537 tonnes, an increase of about 33% from 73,393 tonnes produced in May 2018. The U.S. churned out 475,071 tonnes of primary aluminium in the first five months of 2019, registering a growth of about 39% from the same period of 2018. It is in fact a commendable production growth for an industry which has been constantly showing negative production growth since 2013, running at about 37% of its original capacity.

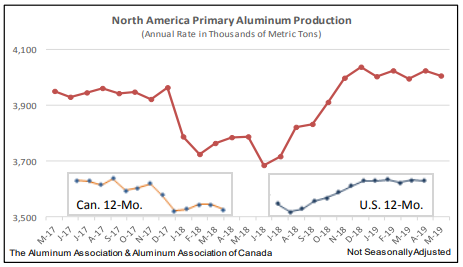

The estimated annual rate of U.S. primary aluminium production totalled 1,148.4 thousand tons during May 2019, an increase of about 33 per cent over the May 2018 annual rate of 864.1 thousand tonnes. Month on month, the annual rate of production was slightly off from the April 2019 annual rate of 1,154.5 thousand tonnes. The year‐to‐date production rate through May 2019 stood at 1,148.4 thousand tonnes, up 39 per cent over the YTD 2018 rate of 826.9 thousand tonnes.

The surge was driven by restarting of capacity by major aluminium producers after tariffs were announced. If the aim of the so-called “Section 232” tariffs was to boost domestic production, Trump administration can put this 39% growth rate as a positive example.

Century Aluminum restarted an idled plant in Kentucky and reactivates a third idled line at its Hawesville smelter in Kentucky. The first line started in the third quarter and the second was due by the end of last year. Magnitude 7 Metals has resumed operations at the New Madrid smelter in Missouri, which was on the card, encouraged by the tariffs. Similarly, Alcoa’s restart of idled capacity at its Warrick smelter in Indiana was announced at the end of 2017 and it was further encouraged by the tariffs. Though restarts started after the tariffs, the decisions were taken beforehand.

Canada’s primary aluminium production however, dropped in the first five months of 2019 driven by labour issues at one of the smelters. Canada produced 2,42,640 tonnes of primary aluminium in May, about 2.2% less than the volume produced in May 2018. Canada churned out 1,183,539 tonnes of primary aluminium in the first five months of 2019, registering a drop of about 2.9% from the same period of 2018. Canadian aluminium industry has not seen much of an impact on its production because of the tariffs. ABI smelter, owned by Alcoa (74.95%) and Rio Tinto Alcan (25.05%), with an annual operating capacity of 413,000 tonnes per year has been operating at a reduced capacity since January 11, 2018 as the United Steelworkers rejected a labour contract for the hourly workers. If the labour issue gets resolved, Canada will bounce back with its nameplate capacity.

Total North American primary aluminium production for the first five months of 2019 stood at 1,658,610 tonnes, up from 1,559,938 tonnes in the same period of 2018.

It remains to be seen how much more dormant capacity will be back into life because the price of aluminium is currently hovering at a low range and managing profitability with such low price will be tough for smelters. No primary producers have announced plans to build new aluminium smelters in the United States. Analysts don’t expect them to announce new projects despite the tariffs because of the high American electricity costs and labour costs.

The U.S. will continue to remain import dependent in case of aluminium and aluminium semis and China’s semi-finished export will continue to rise due to slower domestic demand growth. Aluminum Association estimates that even if all the idled capacity in the country were restarted, the U.S. could still meet less than half of its primary needs. The OECD has concluded in a recent report that “market distortions appear to be a genuine concern in the aluminium industry”. Chinese overcapacity remains a true concern and aluminium associations across the world are demanding a solution to China’s massive production and export capacity. We will again come up with an analysis of the trends after the third quarter, however, the numbers are not likely to see a significant change from the first two quarters, though year-over-year the U.S will register an increase in production.